[最も欲しかった] tax invoice 143809-Tax invoice australia

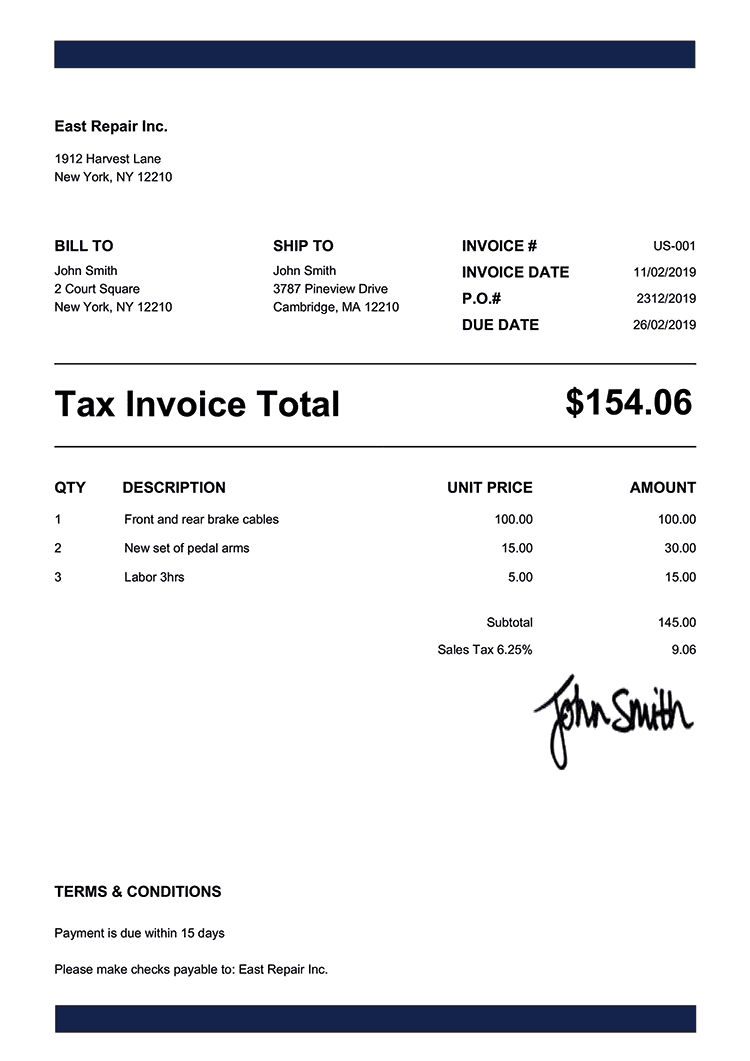

Apr 04, 21 · The Tax Invoice has nothing to do with the sales tax that eBay collects from buyers It's all about the fees that the seller has paid For nonUS sellers, their fees may be subject to taxA tax invoice shows the taxes on goods and services It's an itemized list of charges for individual products sold or services rendered along with the indirect tax amount for each product and service A tax invoice needs to include the description of the product or service, quantities, date of shipment, mode of transport and pricesAustralia VAT Information on Invoices Valueadded tax, VAT, is an indirect tax levied on goods and services at every single stage of the supply chainIn many countries, VAT is called GST, including in Australia The goods and services tax (GST) adds a 10% tax on most domestically supplied goods and services The tax is added to the final price of consumption goods and paid for by the end

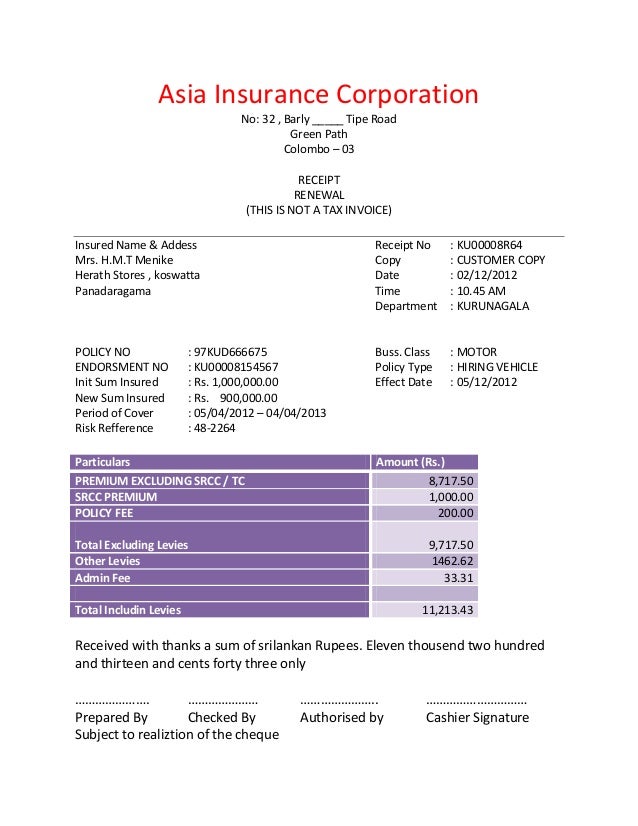

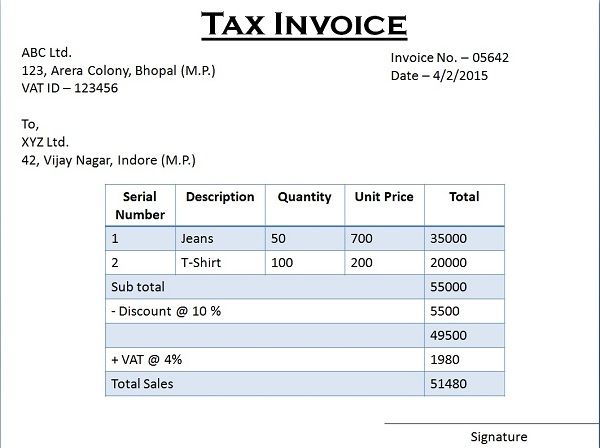

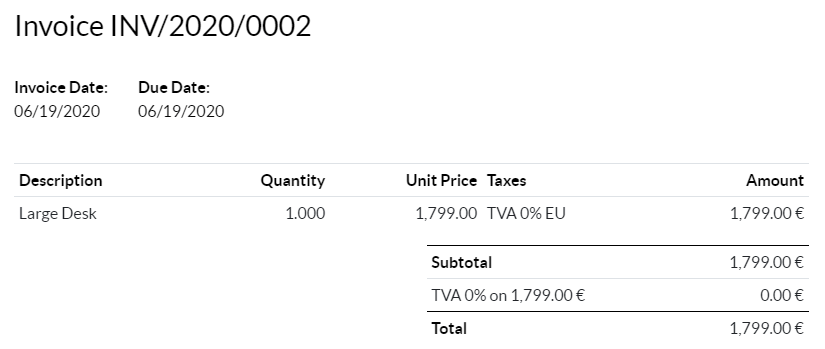

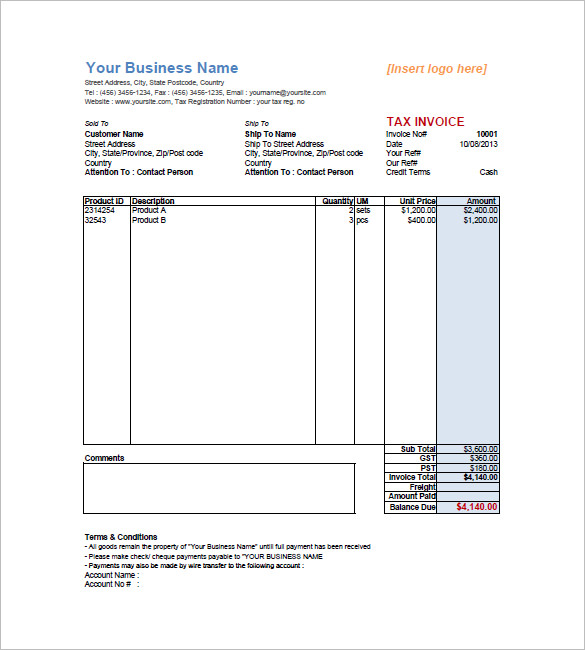

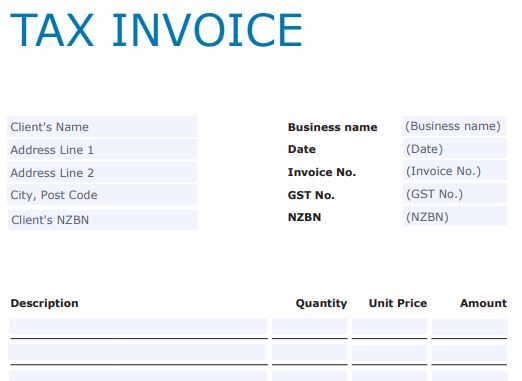

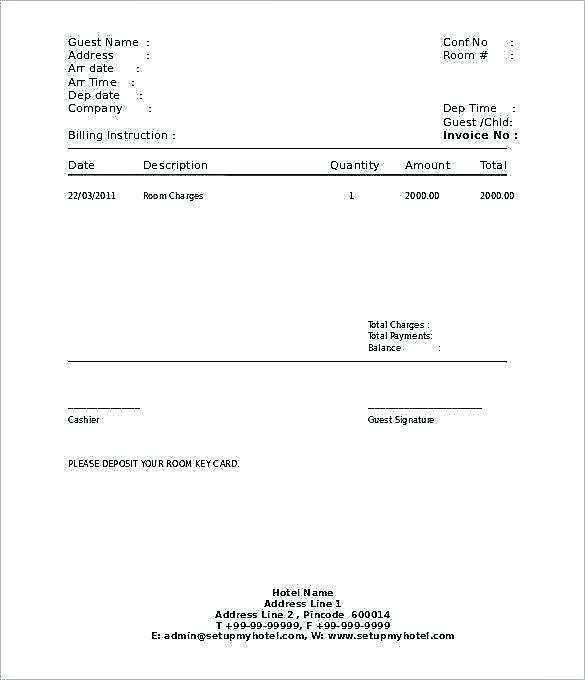

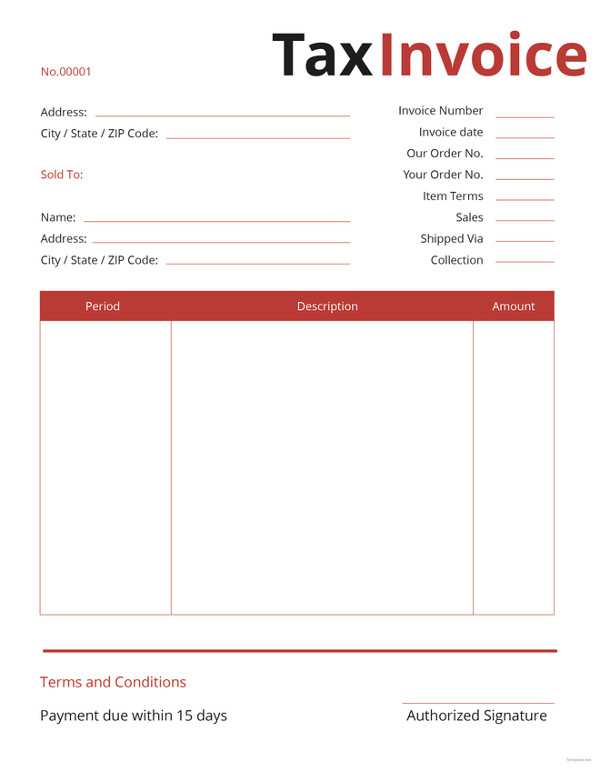

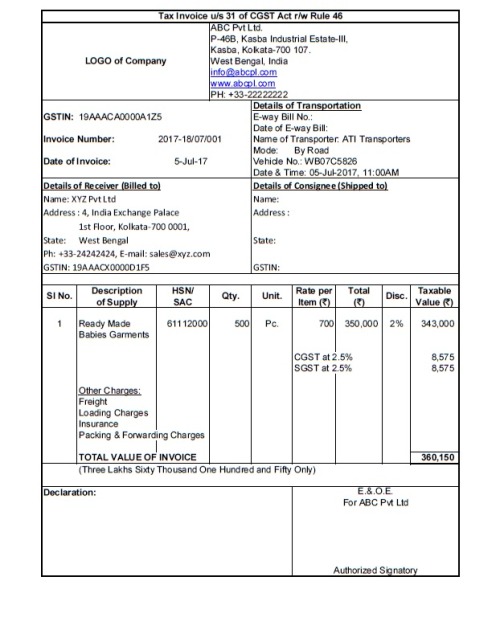

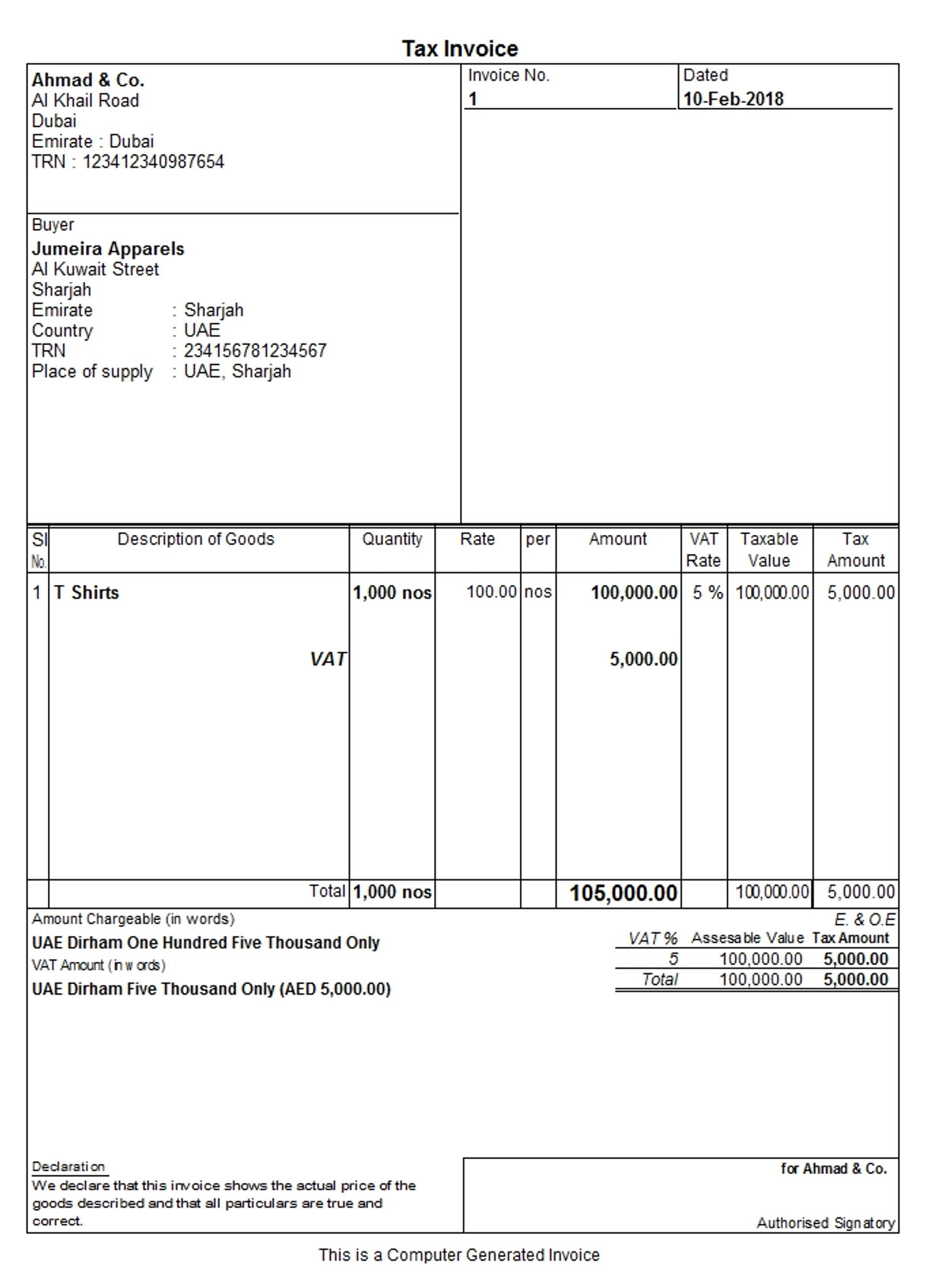

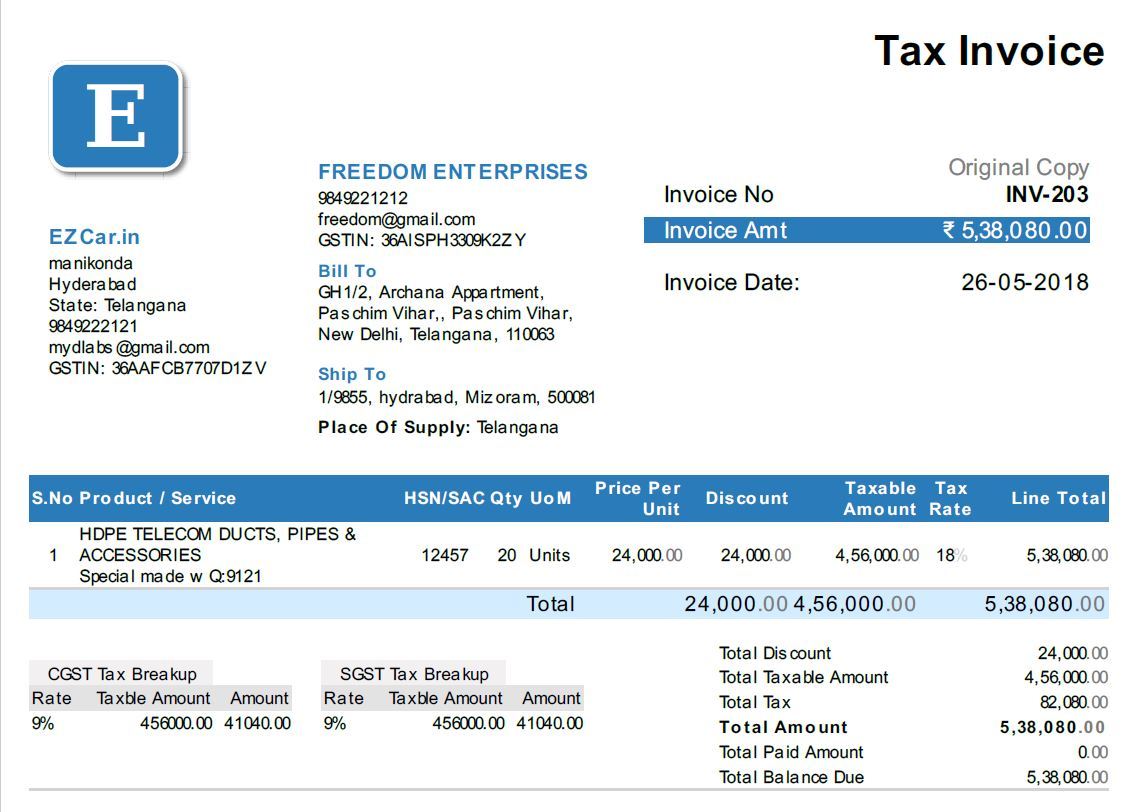

Tax Invoice

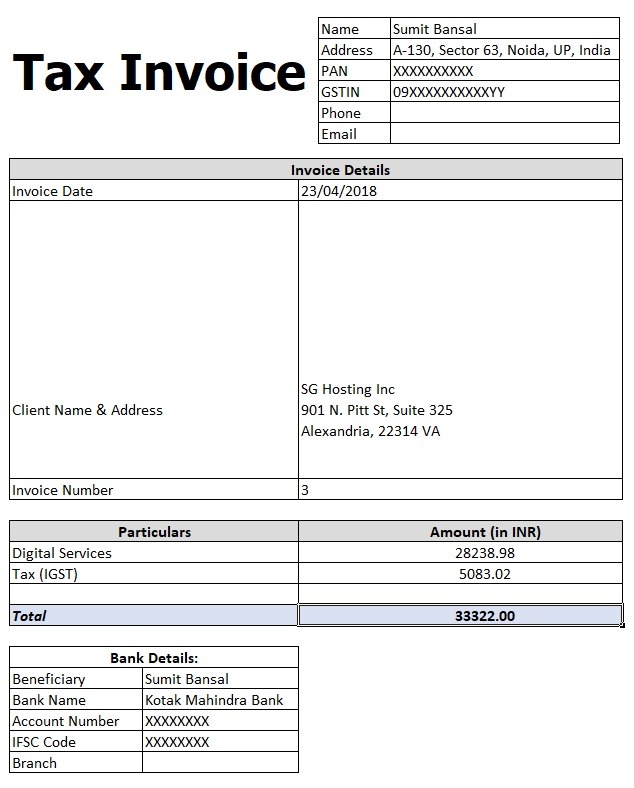

Tax invoice australia

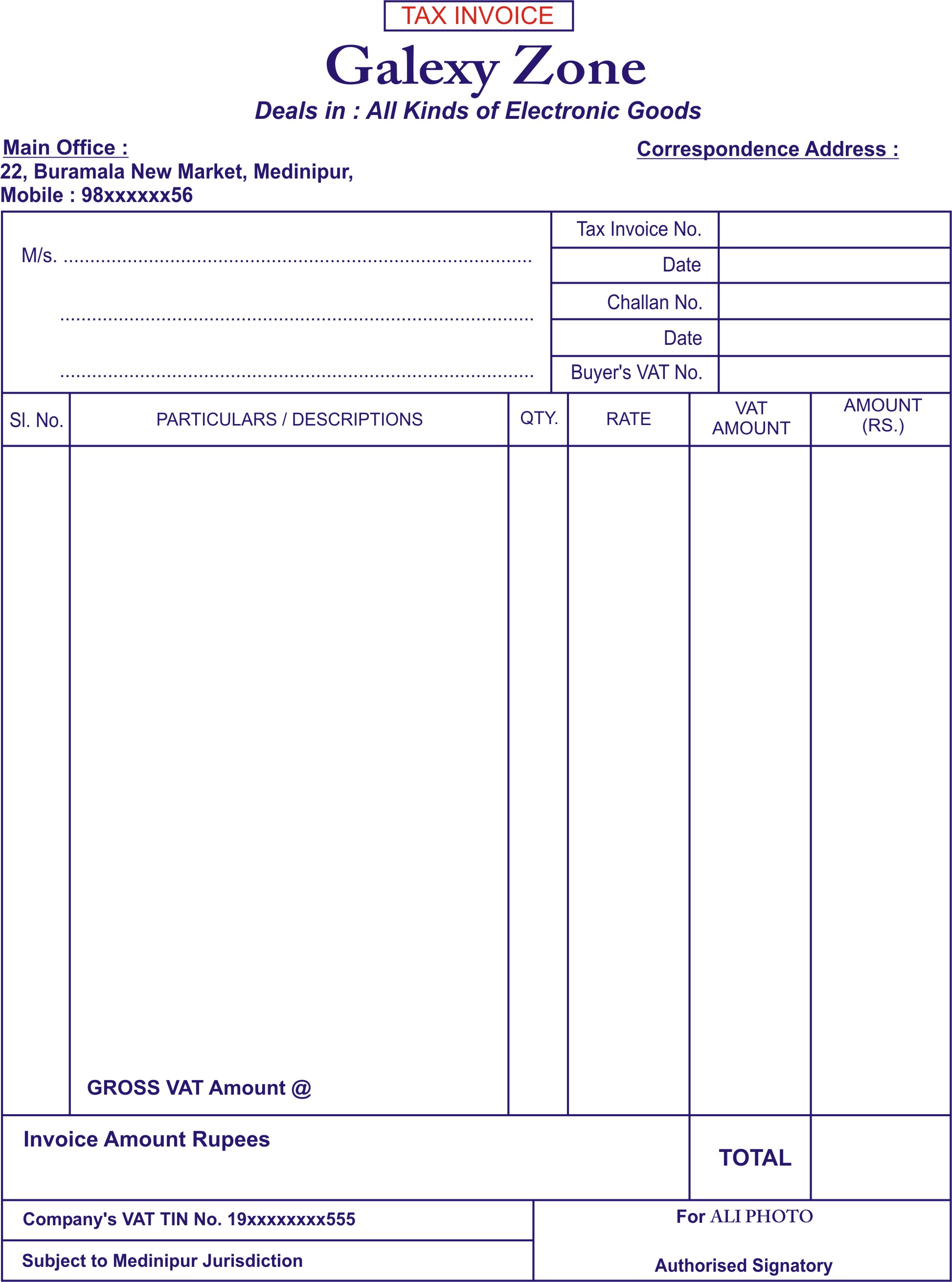

Tax invoice australia-A tax invoice refers to an invoice that is issued to a purchaser by a registered dealer, indicating in detail the amount of tax payable In whatever industry you are in, you will need to pay taxes To keep track of the taxes that your customers need to pay, you need to use professionallydesigned tax invoices This article contains 10 tax invoice examples that you can use to create yourInvoice Date the date of the tax invoice should be entered in column C and is included in cell H11 on the automated quotation and tax invoice When you enter multiple lines for the same quotation or invoice, the invoice date must be the same for all the entries

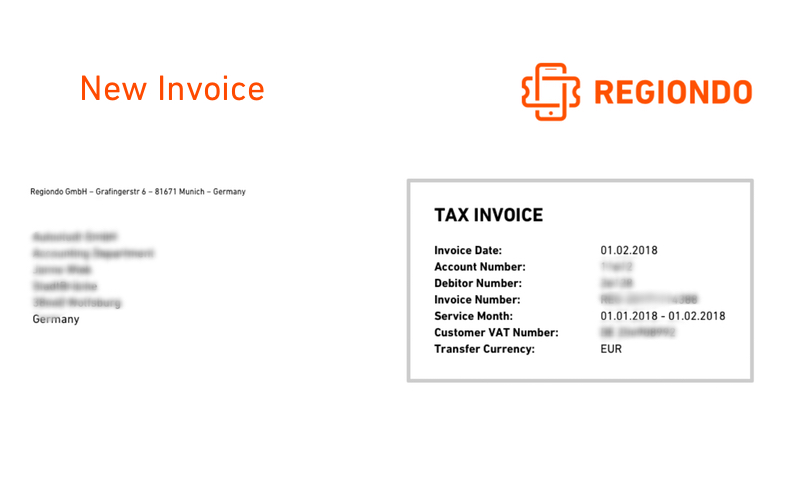

What Is The Difference Between An Operator Invoice A Tax Invoice And A Sales Receipt Regiondo Gmbh Knowledge Base

The most important document in such a system is the tax invoice Without a proper tax invoice a business cannot deduct input tax on business expenses The VAT Act prescribes that a tax invoice must contain certain details about the taxable supplyUsage of the AirAsia website states your compliance of our Terms of use and Privacy policy ©15 AirAsia This website is owned and operated by AirAsia BerhadA tax invoice is a legal document issued to a registered purchaser, (usually not the end consumer), during a sale by a registered seller Invoices are created in triplicate;

Tax invoices are not available in realtime and typically take anywhere from 48 hours up to 5 day s before they are available for download from the Order detail page If your region requires tax breakdowns, registration numbers, and invoices or purchase receipts, you'll find them inInvoice software is one of the best ways to ensure your invoices are tax compliant every time QuickBooks, for example, allows you to create custom branded invoices with all the fields required for a SARS compliant invoice It also speeds up and automates a lot of the processes around billing Save tax compliant invoice templatesA tax invoice/ customer accounting tax invoice is the main document for supporting an input tax claim You must keep these tax invoices issued to your customers, and those given to you by your suppliers, for at least five years You do not need to submit them with your GST returns When to Issue a Tax Invoice

Feb 07, · Tax Invoice Format of Purchaser or Supplier The Tax Invoice Format of Purchaser or Supplier is similar to a GST Invoice as following conditions that bill of purchaser or supplier does not contain any tax amount as the seller cannot charge any GST amount to the Purchaser or Supplier GST goods/services are selling to Register Persons,What is a Tax Invoice?A tax invoice is a document that breaks down the goods or services purchased by an individual or entity from another individual or entity and the corresponding taxable amount for all eligible goods or services purchased A simple invoice is also called a nontax invoice because it does not account for the taxes payable for that specific transaction

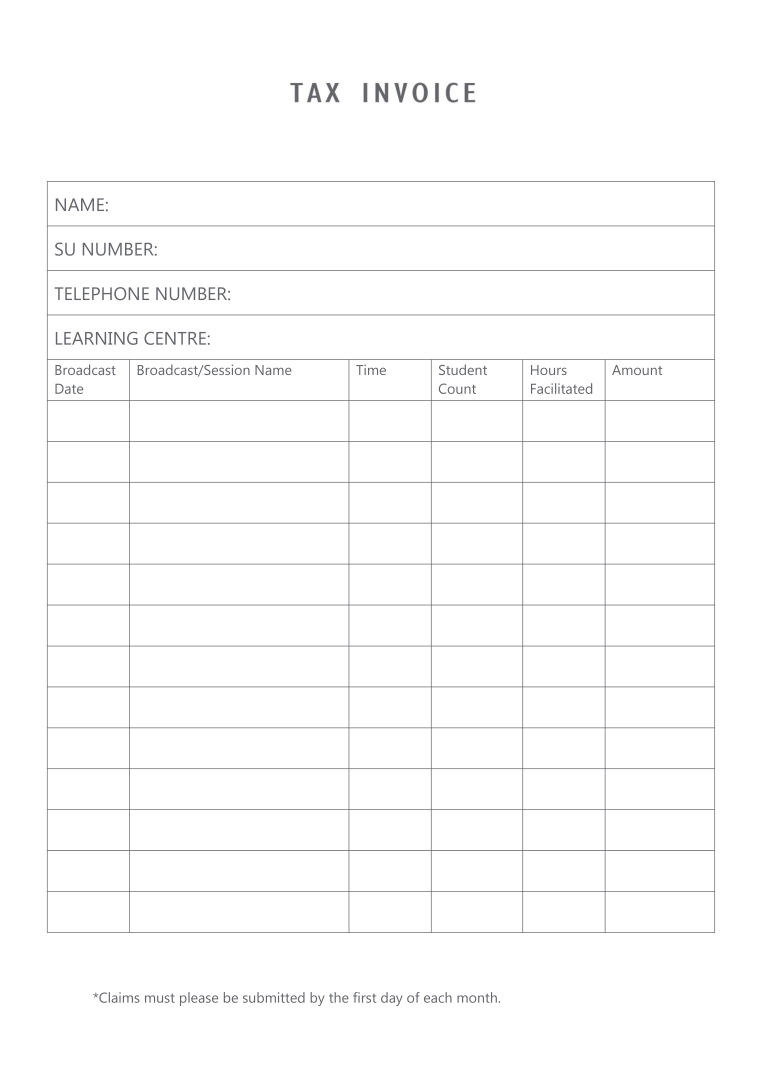

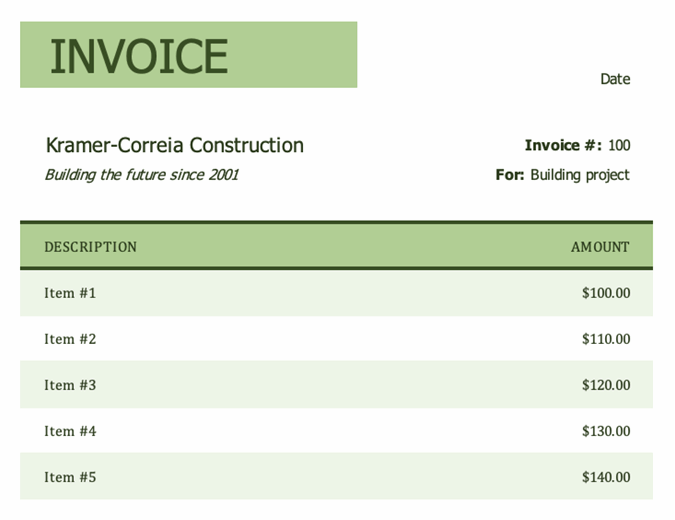

Tax Invoice Templates Quickly Create Free Tax Invoices

Tax Invoice Display Of Information

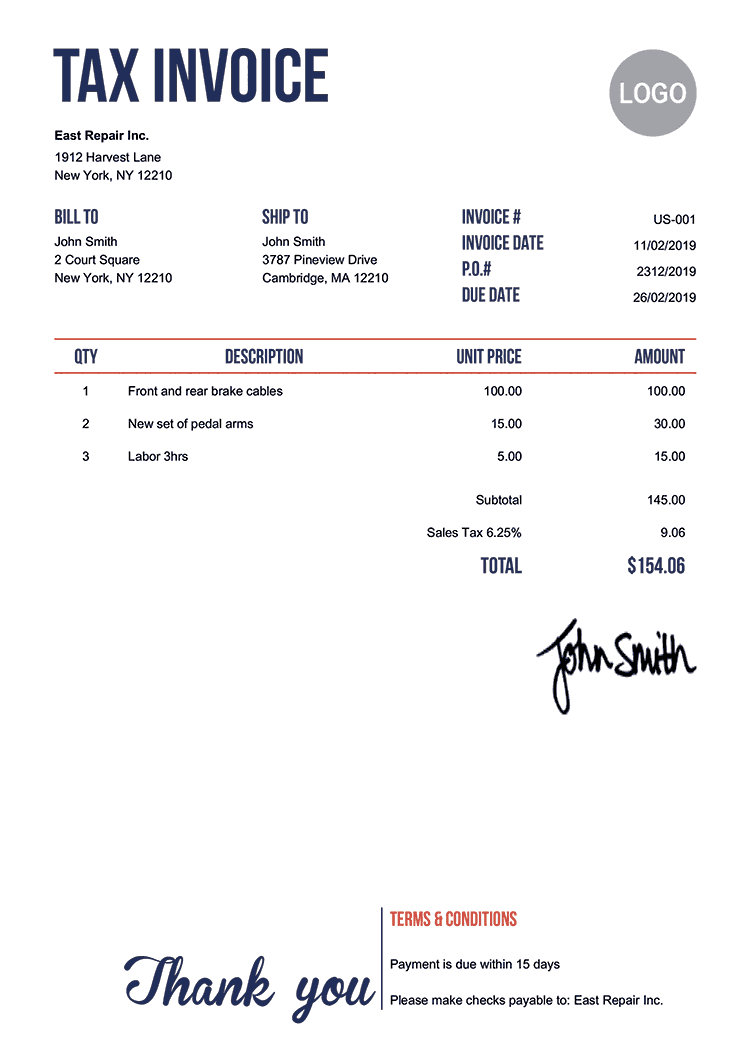

Mar 03, · Tax Invoice This Tax Invoice is for use by a business (whether a sole trader, company, or something else), when charging a client or customer for goods or services Within the document, the Sender of the invoice can provide a reference number for the invoice, as well as a general explanation of what the invoice relates toA tax invoice is an invoice sent by the registered dealer to the purchaser showing the amount of tax payable It includes the description, quantity, value of goods and services and the tax charged If you make a taxable sale, your taxregistered customers need an invoice from you to claim their tax credits for purchasesMar 12, 21 · Tax invoices include the GST amount for each item along with some extra details You need to provide a tax invoice if any of these apply The purchase is taxable The purchase is more than $50 (including GST) Your customer asks for a tax invoice If your customer asks for a tax invoice and you're not registered for GST, show on your

Paid Seal Stamped On Tax Invoice Commercial Document Economics And Business Stock Photo Image Of Account Expense

免费sample Tax Invoice 样本文件在allbusinesstemplates Com

May 22, 18 · Tax Invoice vs Bill of Supply Under the old indirect tax system, you had to create a tax invoice or a retail or commercial invoice for most sales But under the GST, you have to generate a tax invoice or a bill of supply, and the invoice requirements have changed Here's an overview of when to use these documents and what to include on themTax Invoice Template Business Name Business Address 1 City, State Postal Code Company Phone Number Company Emaill Address Invoice Client Name Client Address line 1Select a Tax Invoice Template & Create as PDF New Invoice · Tax Invoice · Proforma Invoice · Receipt · Sales Receipt · Cash Receipt Quote · Estimate · Credit Memo · Credit Note ·

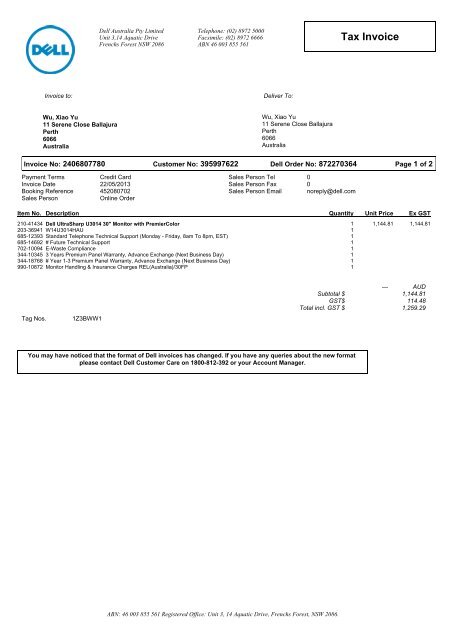

Tax Invoice Dell Community

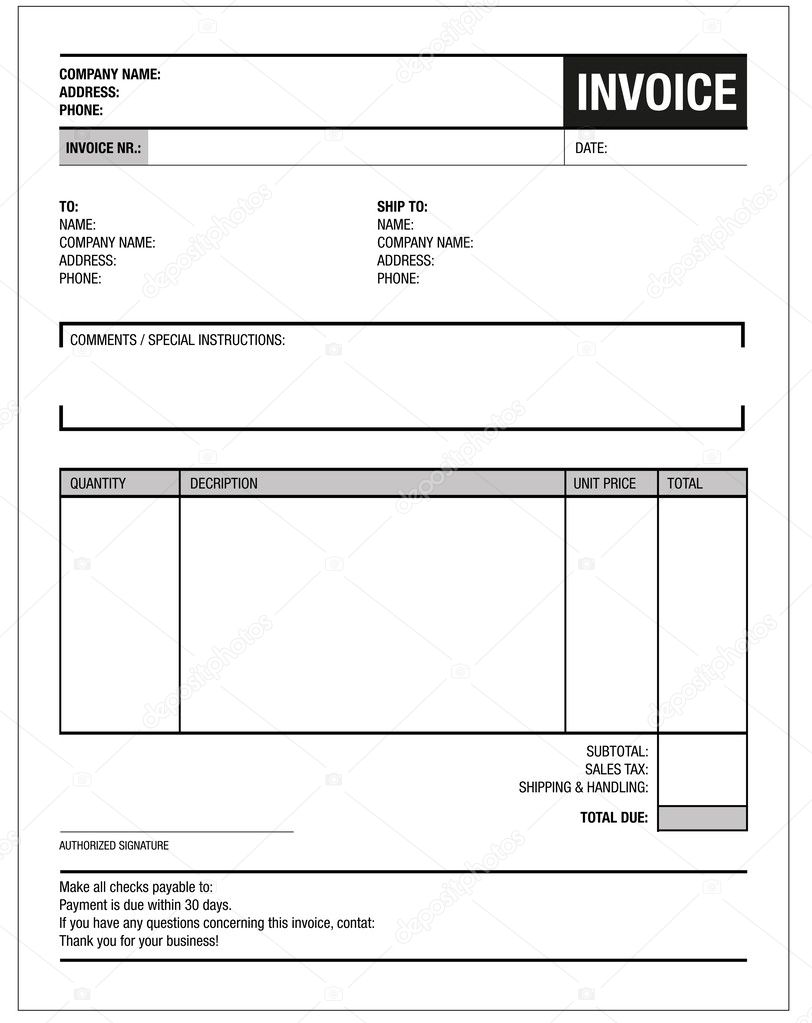

Template Of Unfill Paper Tax Invoice Form Vector Image By C Grounder Vector Stock

Apr 23, 17 · GST requires that a tax invoice or bill of supply to be issued before or on the occurrence of certain event or within a prescribed time Therefore, an invoice is required for every other form of supply such as transfer, barter, exchange, license, rental, lease or disposalThe tax invoice must contain seven facts as per the GST Tax Law Variations There are different types of invoices Pro forma invoice – In foreign trade, a pro forma invoice is a document that states a commitment from the seller to provide specified goods to the buyer at specific pricesSecurities fraud (SEC whistleblower cases) Health and safety violations;

Regenerate A Tax Or Vat Invoice From The Dashboard Stripe Help Support

The Tax Invoice From Regiondo Regiondo Gmbh Knowledge Base

VAT refers to the Value Added Tax, a kind of common tax that applies to many businesses This file is a VAT Invoice Template After a quick review, you can find that this template adds the tax information to the basic format of an invoice, which usually consists of four parts, including the contact information, the invoice information, details of the transaction and the paymentThe tax invoice is a normal template that can be used by any company Just add the details of the company and the customer, the quantity, the description of the salary, amount and the total sum, and the invoice is ready Simple Tax Invoice Template Download DOCX FormatAdd your business and your client's details Change the invoice format via the button below Add or edit the Taxes or Discounts if applicable from the "% Taxes" and "Discounts" buttons After adding all the details you can download your invoice as "PDF", print it

Tax Invoice

Ebay Sellers Confused By Tax Invoice

A tax invoice is a legal document that a seller submits to a customer in which the tax is included or a document (in India) from a registered supplier to a registered dealerA tax invoice is an instrument that is sent by the registered person to the purchaser showing the details supply of goods/services with GST tax amount It includes the quantity, value of products and services, data of invoice, invoice no GST noWith servicespecific templates for invoices, you can enter quantities and unit costs for labor and sales and even adjust the invoice template to double as a receipt You'll also find invoicing templates and billing statements that deduct deposits or provide tax calculations

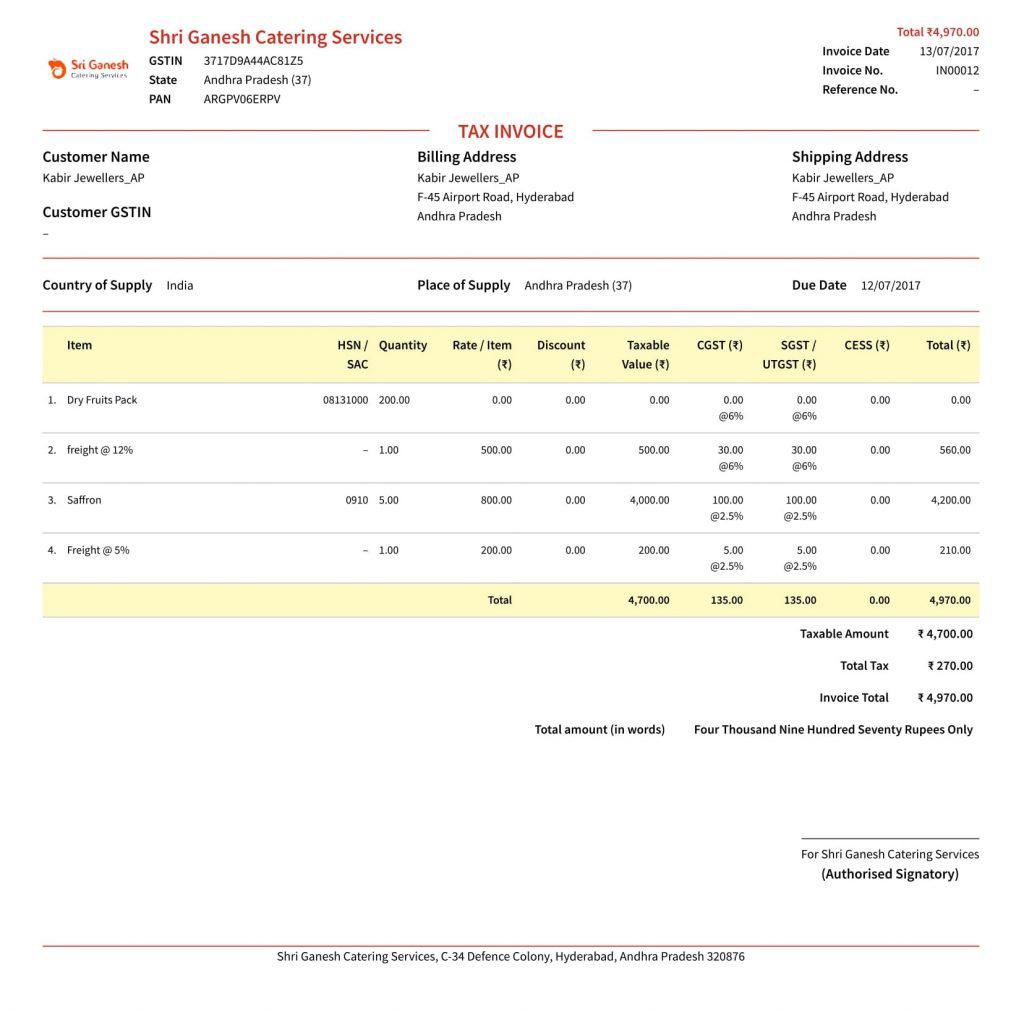

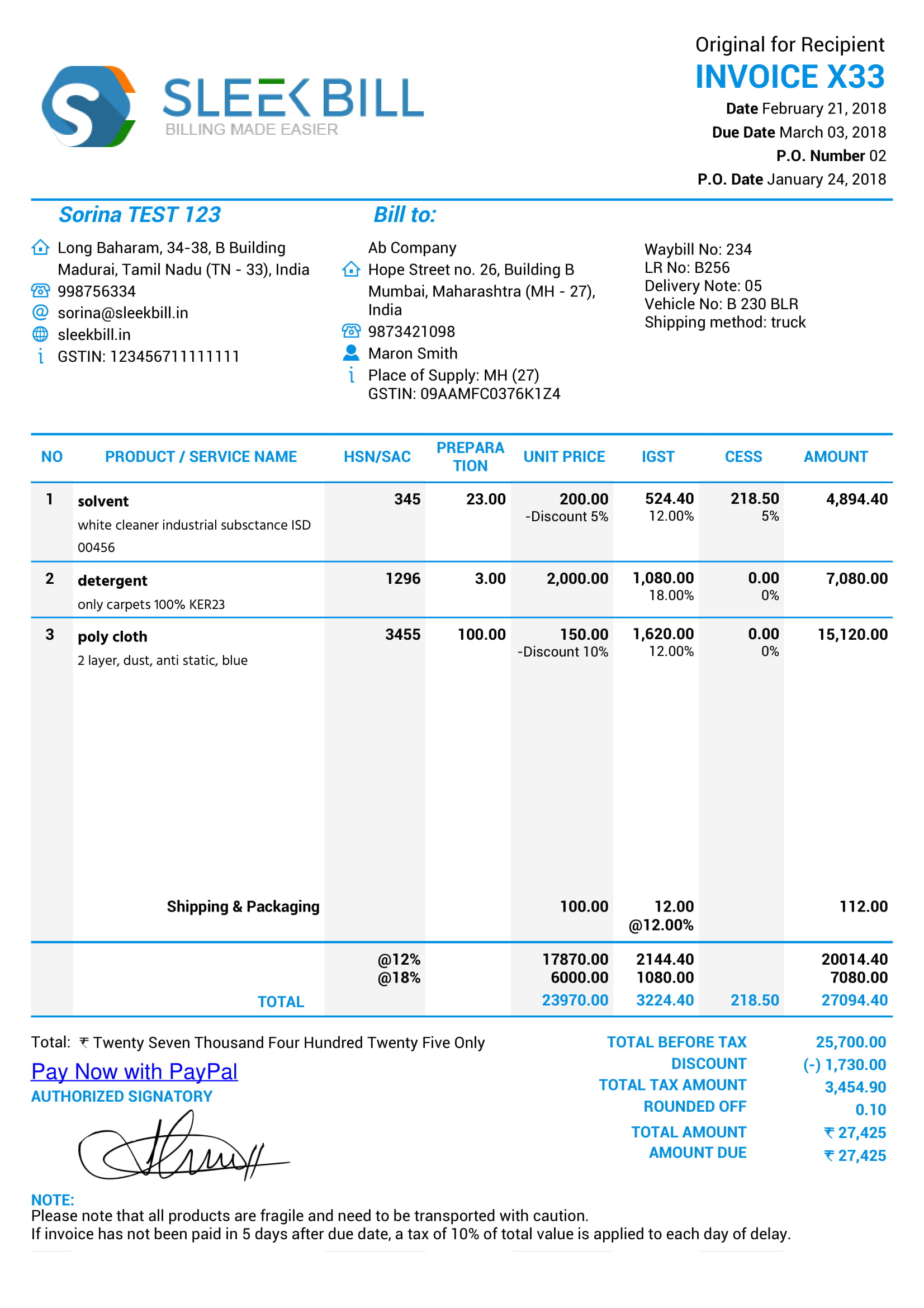

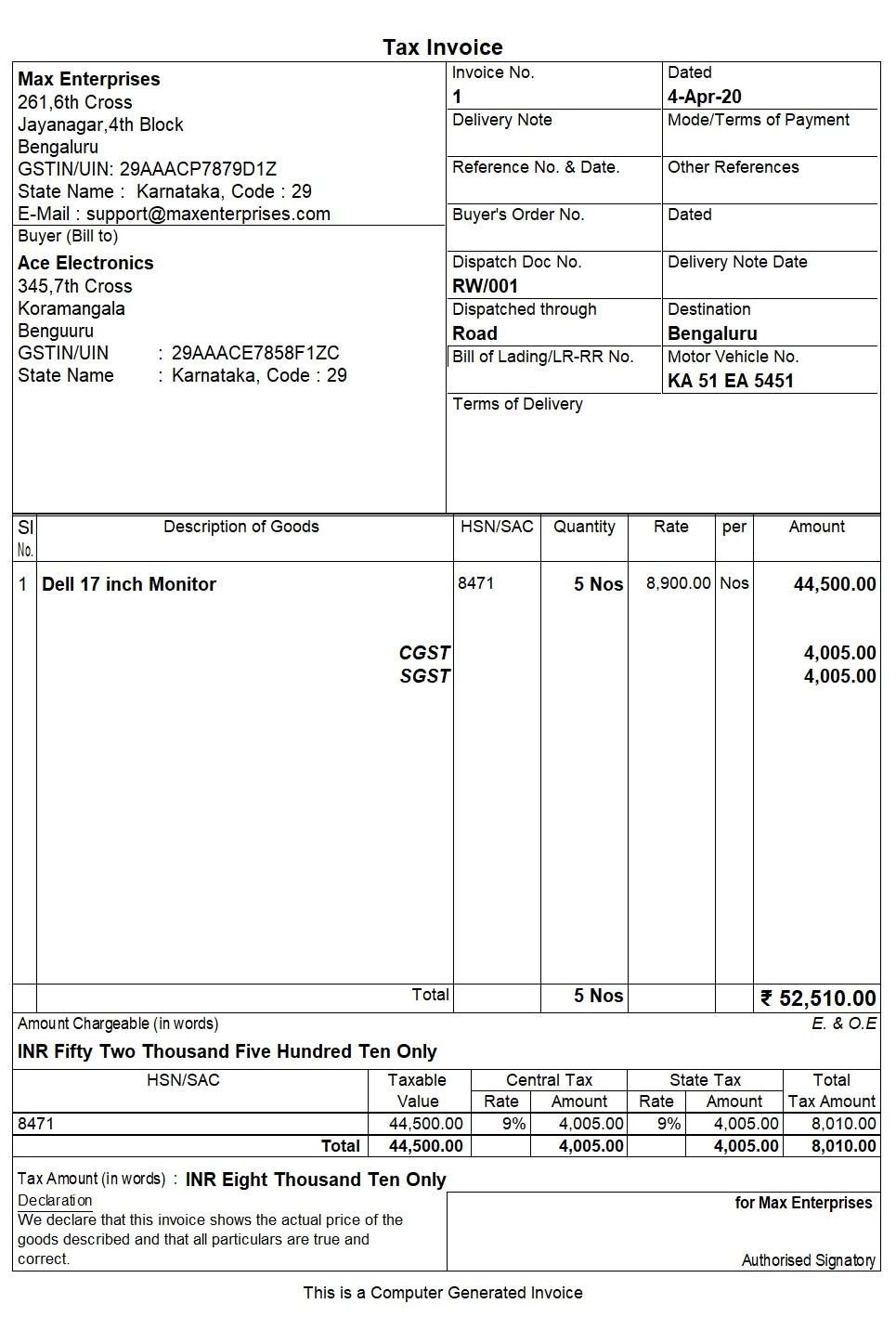

Gst Invoice Guide Learn About Gst Invoice Rules Bill Format

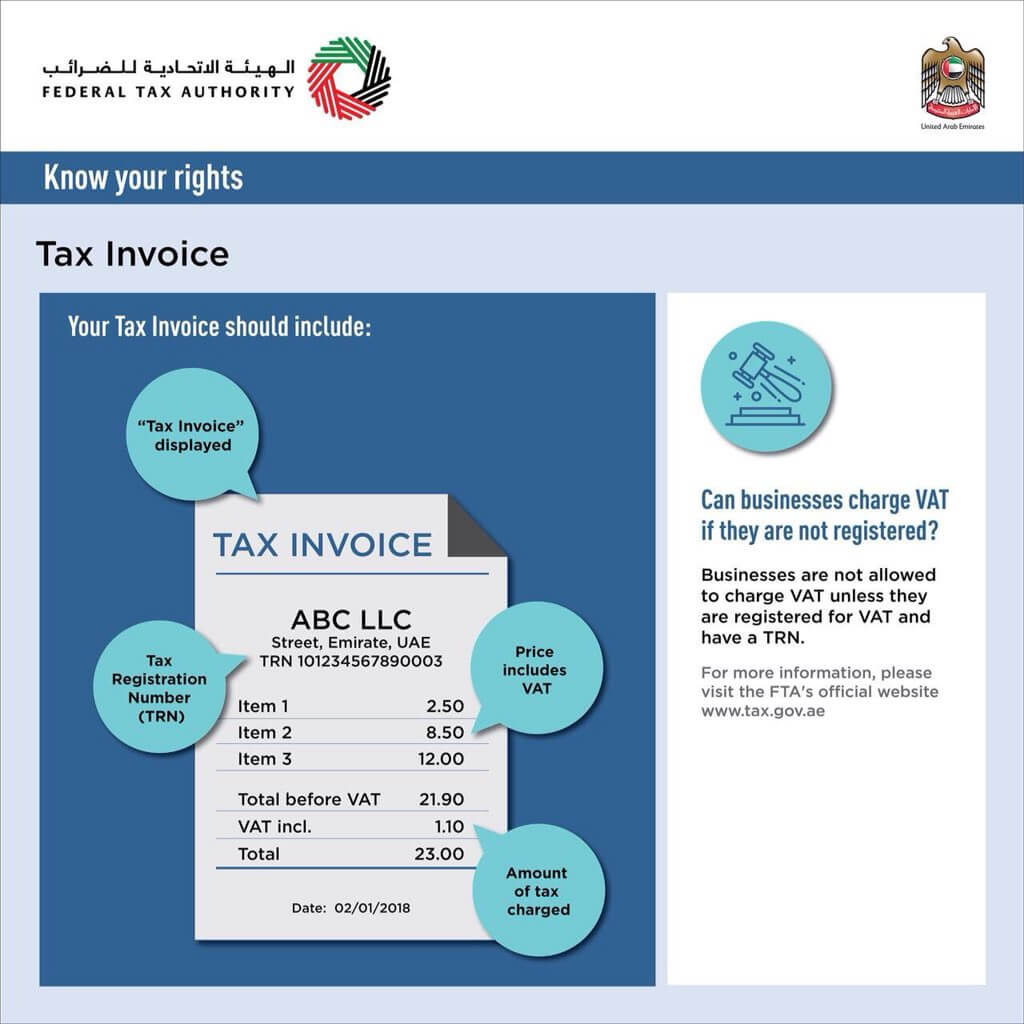

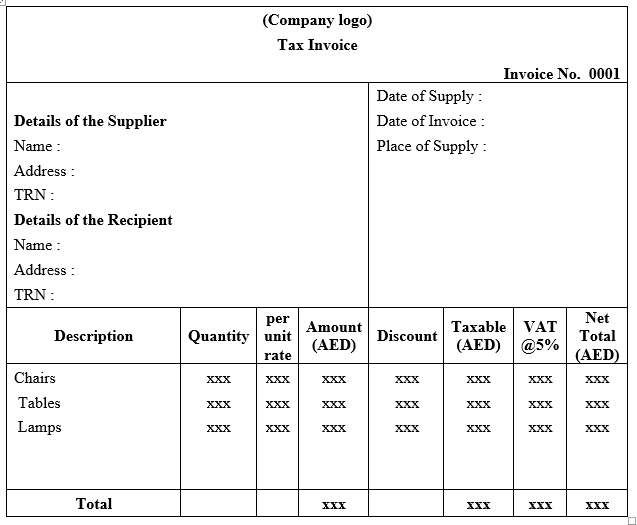

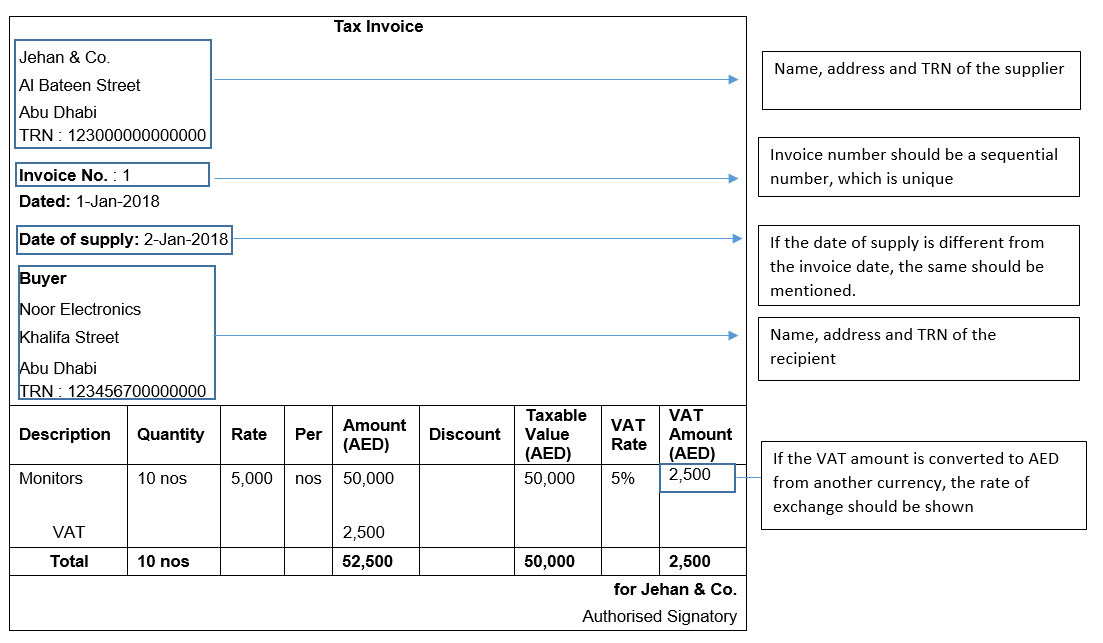

Vat Invoice Format In Uae Fta Tax Invoice Format Uae

Toda's topic "Tax Invoice Format"Looking for an excel invoice format for the revolving of cash flows and counseling the circle of finances at the government sector, the government imposes various kinds of taxes to generate revenueTherefore there are properly calculated tax invoicesThese invoices are generated and issues to keep an accurate track of the amountA tax invoice is no different, but it also serves an additional purpose to help buyers, sellers, and tax authorities understand and process the tax due on specific salesDefault tax rates apply to all line items on the invoice For more complex use cases, you can also set an item level tax rate that overrides the default tax rate If creating an invoice through the Dashboard , assign default tax rates to apply to the invoice

Group Invoice Is Not Able To Print Tax Invoice Helpdesk Stayntouch

Tax Invoice Requirements Blog

Tax Invoice is the essential document to be issued by a registrant when a taxable supply of goods or services is made Under VAT in UAE, a Tax Invoice is to be issued by all registrants for taxable supplies to other registrants, where the consideration for the supplies exceeds AED 10,000Apr , 19 · Tax Invoices Getting a tax invoice for your flights is no problem at all Simply log in to our change bookings portal using your booking reference and the last name of one of the passengers This can still be done even after a flight has been completed Once you are in, you'll see a pink and white button that says "Request VAT invoice"Check in and Baggage Drop Off Times Manage your Booking Change Booking Request a Tax Invoice Travel Documentation Travel Agent Info 4Z ADM Policy 4Z Refund Policy Download App

Download Excel Format Of Tax Invoice In Gst Gst Invoice Format

1

Mar 08, 16 · Conversely, Invoice is a sort of bill, displaying the amount due to the buyer Proforma invoice is used for the creation of sales, whereas invoice is used for confirmation of sale Proforma invoice is provided by the seller, on the request of the buyer before the placement of the order As opposed to invoice, which is issued by the seller toMar 01, 21 · Tax invoice means 'Income Tax' they assume you will use for Income Tax deduction (translation breakdown remember, Adyen is from another country) Has NOTHING to do with SALES TAX IF you look closely at it, it is nothing but ALL THE FEES you are paying, Final Value, Listing Etc Everything 'except' the 'Monthly Store Fee'Apr 07, 21 · Tax invoices are generated when valueadded tax (VAT) is realized Microsoft Dynamics 365 Finance automatically generates a tax invoice when a sales order, a purchase invoice, a purchase order, or a payment that generates a realized VAT entry is posted If an unrealized VAT entry is generated, an invoice is generated instead of a tax invoice

Checking My Tax Invoices Shopee My Seller Education Hub

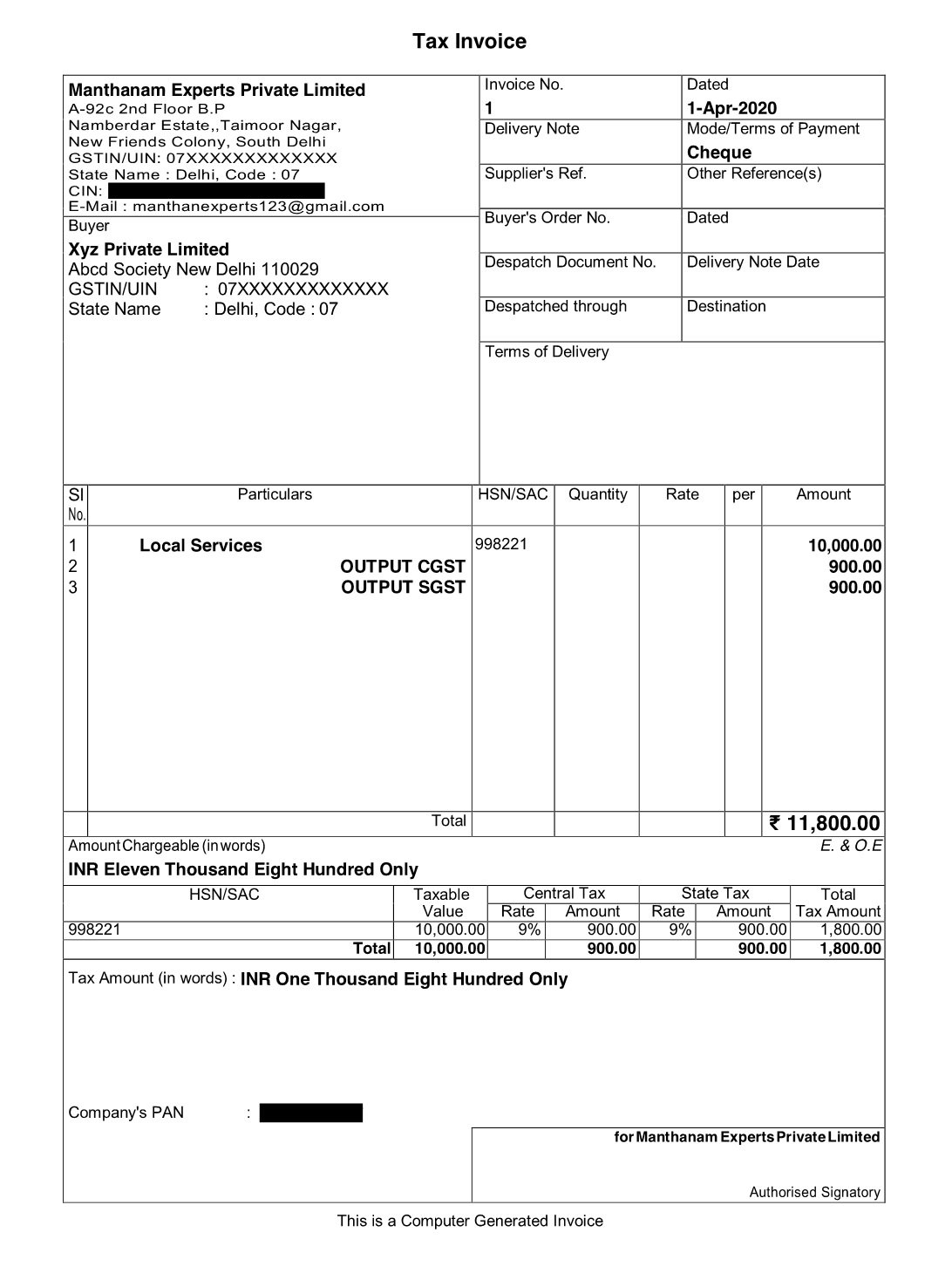

Tax Invoice Under Gst Goods Service Tax Manthan Experts

Clay Center, KS 712 Fifth Street Suite 102 Clay Center KS Directions Phone Fax Emails Email Accounts Payable Email TaxOct 10, · The Tax Invoice could be either a written or electronic document as per the UAE VAT Law As per Article 65 of the VAT Law, the registrants who make the taxable supply should issue the original Tax Invoice and deliver the same to the recipients of goods and servicesMay 29, 19 · The Government has passed legislation regarding the GST tax invoice rules, and these were implemented in India on July 1st, 17 It is necessary for any type of sellers to prepare a valid GST invoice, and send it to the buyer for necessary action Failure to do so will make the business transaction invalid and invite punitive action legally

Australian Invoice Requirements Start And Grow Your Business

How To Provide Eu Vat Tax Invoices In Easy Digital Downloads

May 02, · Recipientcreated tax invoices There is a scenario when the tax invoice is created not by you but by the buyer too Yes, in general, the seller or the service provider creates the invoice and that is what we have been discussing so far But there is situation when the receiver creates an invoice themselvesHealth care fraud (Medicaid fraud and Medicare fraud) Tax fraud and tax evasionMar 31, · It is a legal requirement that a tax invoice is issued by the supplier, provided that they are taxregistered and then delivered to the buyer in each sale or transaction This rule applies even if the tax invoice issued is a simplified tax invoice Tax invoices are not provided only upon request of the recipient What is a simplified tax invoice?

Tax Invoices For Multiple Supplies

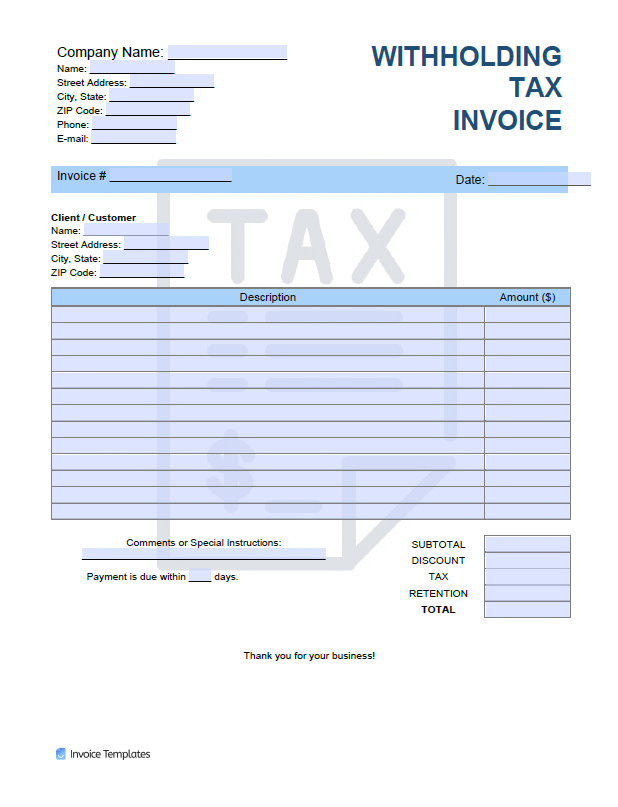

Free Withholding Tax Invoice Template Pdf Word Excel

Sep 26, 17 · A tax invoice is documentation used specifically with international shipments to denote the foreign sales tax applied to commercial goods Basic Differences A pro forma invoice lays out the different products, services, quantities, itemized costs, weights and total costs for items included with a shipmentMilitary contractor fraud/defense contractor fraud (bid rigging, invoice issues such as overcharging, contract violations) Procurement fraud;Dec 26, 19 · All bank wiring instructions will be shown on the invoice Financing available with AgDirect upon request /approval Kansas SALES TAX is 75% and applied to all purchases that are not taxexempt Titled equipment will be supplied a Bill of Sale and tax and license requirements will be subject to the rules in the State of the purchaser

Tax Invoice

Gst Tax Invoice Format In India

Get the Uber app on the iTunes store This link opens a new windowThe tax invoice is an invoice issued by a certified seller to the buyer of their goods, showing payable tax The information on a tax invoice includes a description of goods and quantity, value, and the charged tax When a seller makes sales that are taxable, they have to invoice the company or buyer for tax credits on purchases, mostOne is issued to the buyer while two copies are reserved with the seller The final copy will be later submitted to the significant government authority

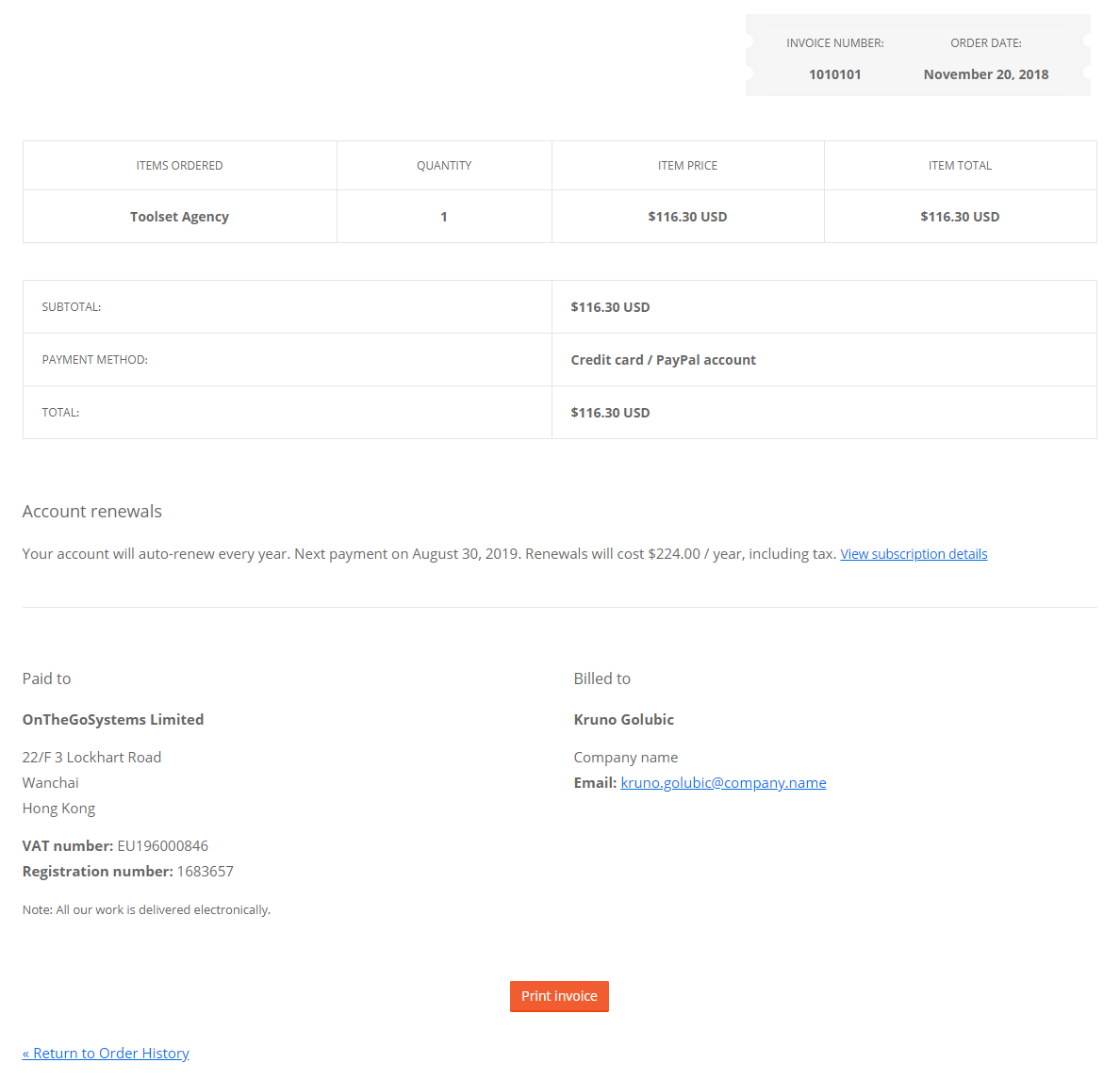

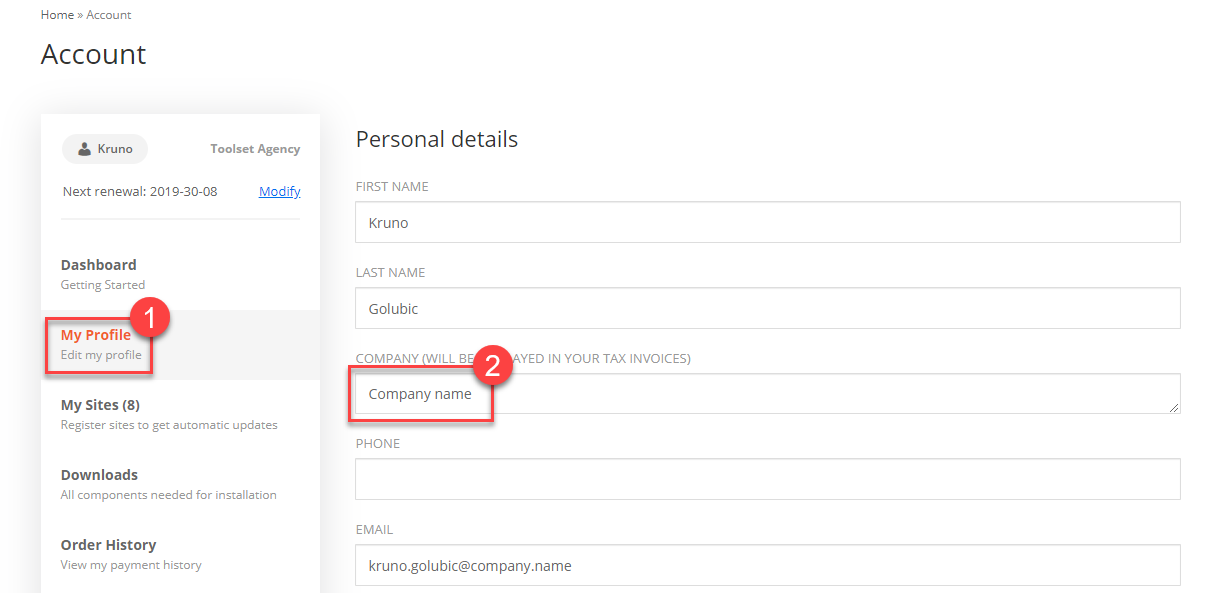

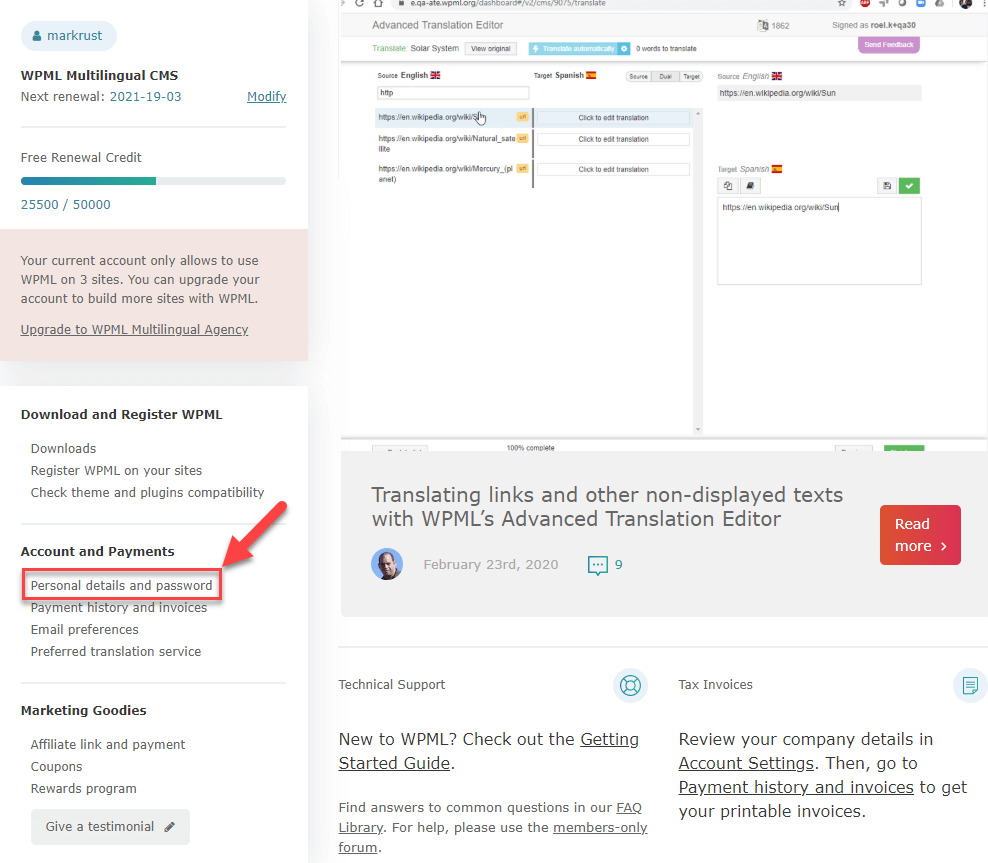

Getting Your Tax Invoice After Buying Toolset Toolset

Batch 360 Thai Withholding Tax And Tax Invoices

Open Source Html Tax Invoice Template By Exotel Team Kailash

Tax Invoice For Goods Delivered For Free Finance Dynamics 365 Microsoft Docs

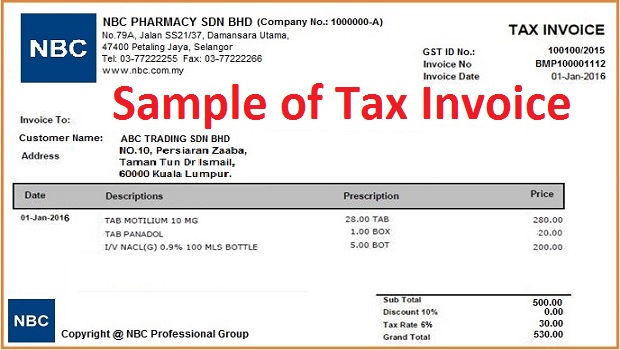

What Is Tax Invoice How To Issue Tax Invoice Goods Services Tax Gst Malaysia Nbc Group

Rishi Raj Sengupta Identity Card And Tax Invoice Design

Tax Invoice Debit And Credit Notes Ca Deepak

What Is The Difference Between An Operator Invoice A Tax Invoice And A Sales Receipt Regiondo Gmbh Knowledge Base

Batch 360 Thai Withholding Tax And Tax Invoices

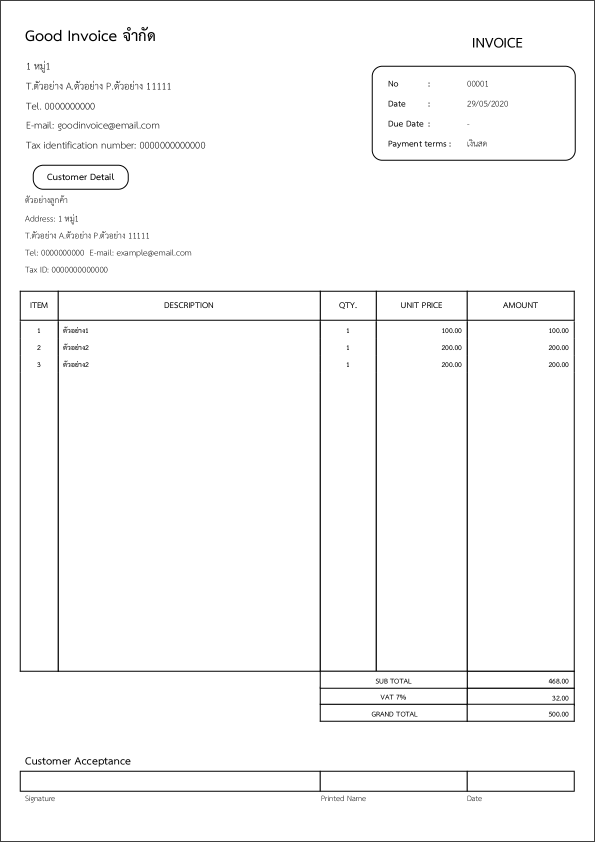

Goodinvoice Create Quotation Receipt Tax Invoice Online

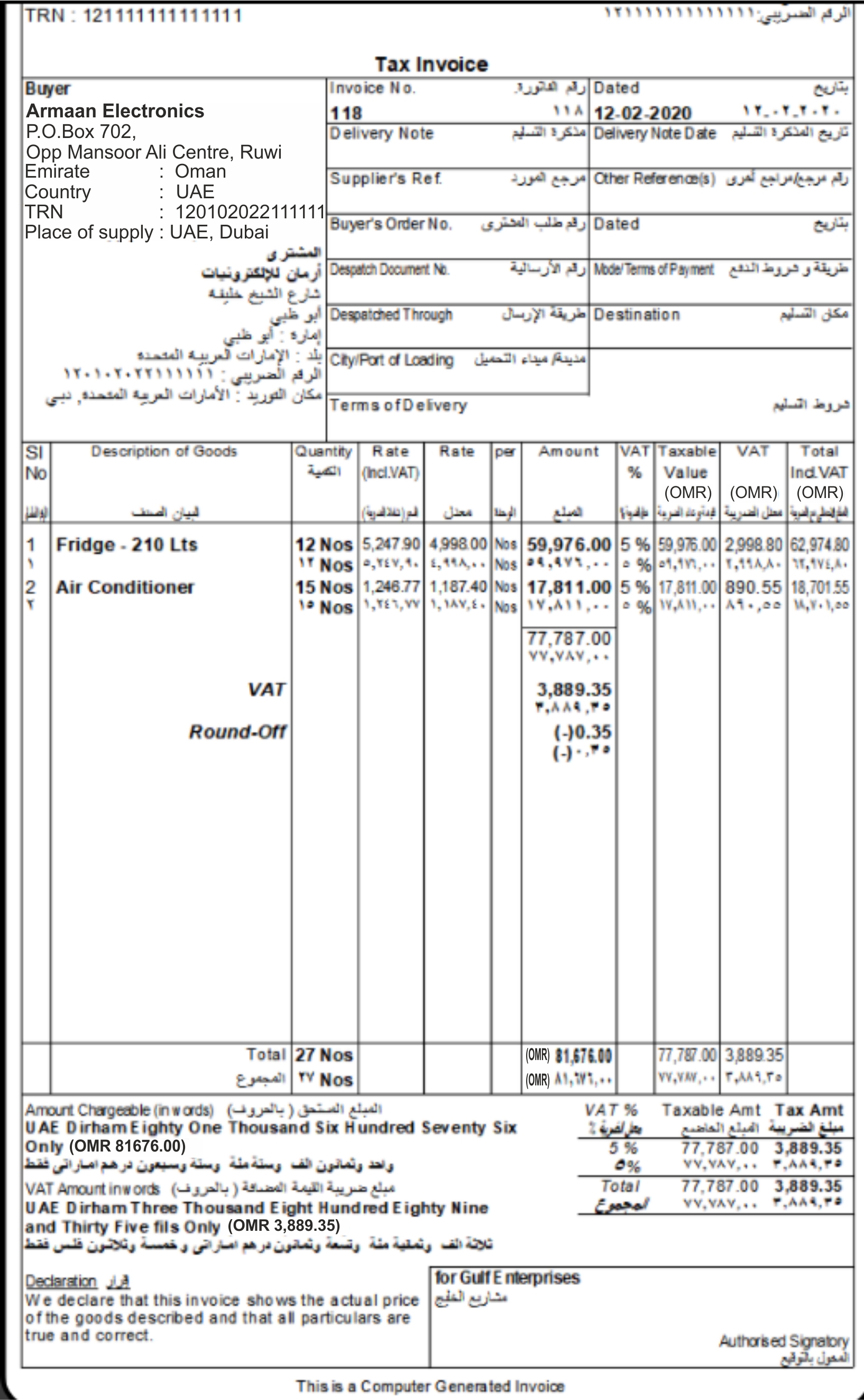

Vat Invoice In Oman Tally Solutions

Pin On Invoice Template

How To Issue Tax Invoice Property Partner Help Center

The When Why And How Of Issuing A Tax Invoice In The Uae Creative Zone Tax Accounting Services Dubai

Tax Invoice Template Templates Free Word Excel Gst Bill Format Receipt Sample Payment Templat Invoice Template Invoice Template Word Vector Business Card

Difference Between Tax Invoice And Retail Invoice With Similarities And Comparison Chart Key Differences

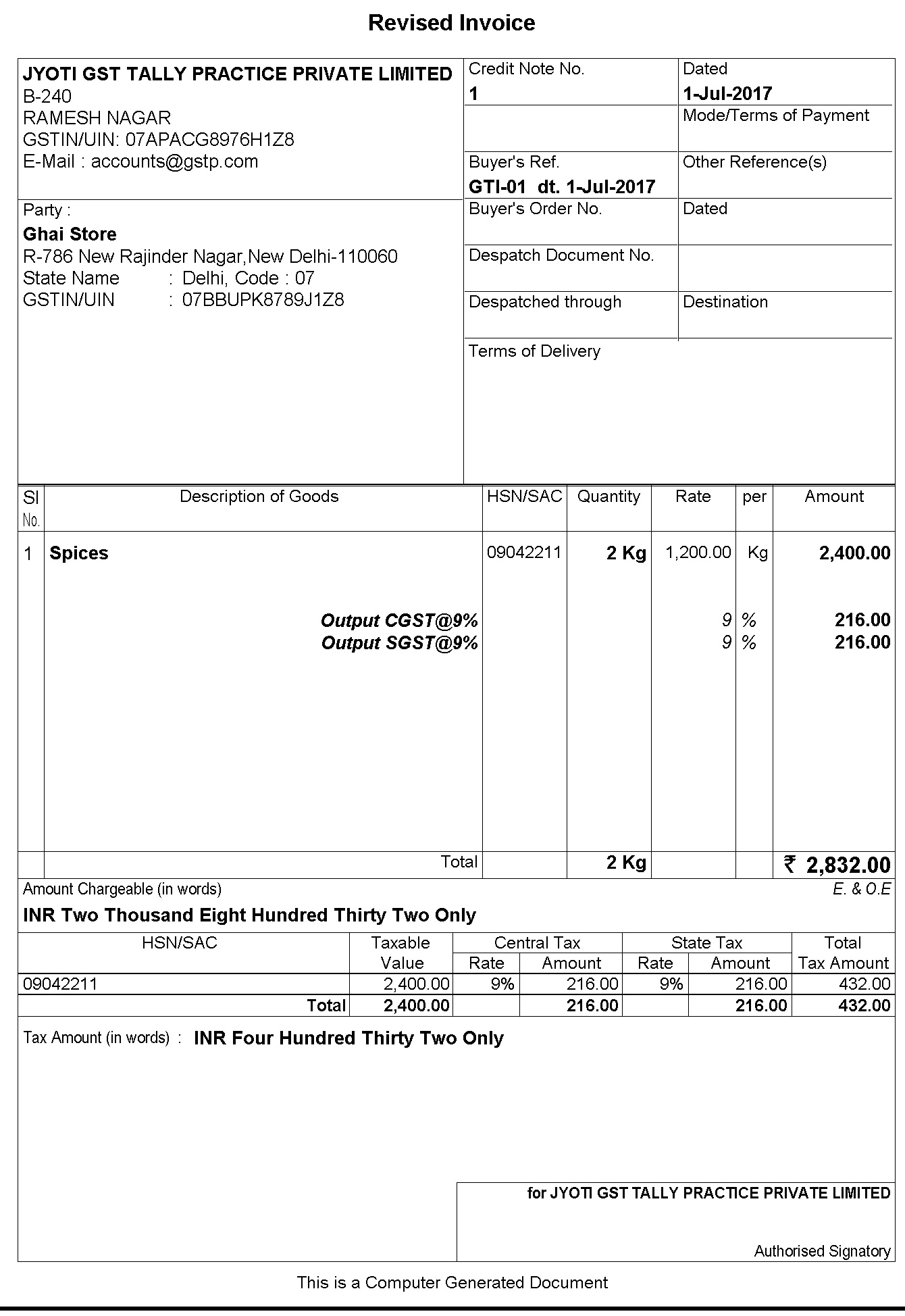

Creating Revision Tax Invoices Changes To Fi Ca Postings Sap Documentation

Spirax Tax Invoice And Statement Book No 500 Officeworks

Tax Invoice Double Colour प पर स ट शनर In Baikampady Mangalore Western Data Forms Id

Taxes Odoo 14 0 Documentation

14 Tax Invoice Templates Docs Pdf Free Premium Templates

Ebay Tax Invoice Explain Flipping

What Information Should A Tax Invoice Include

32 Free Tax Invoice Template Thailand With Stunning Design With Tax Invoice Template Thailand Cards Design Templates

Icanlocalize Documentation Tax Invoices

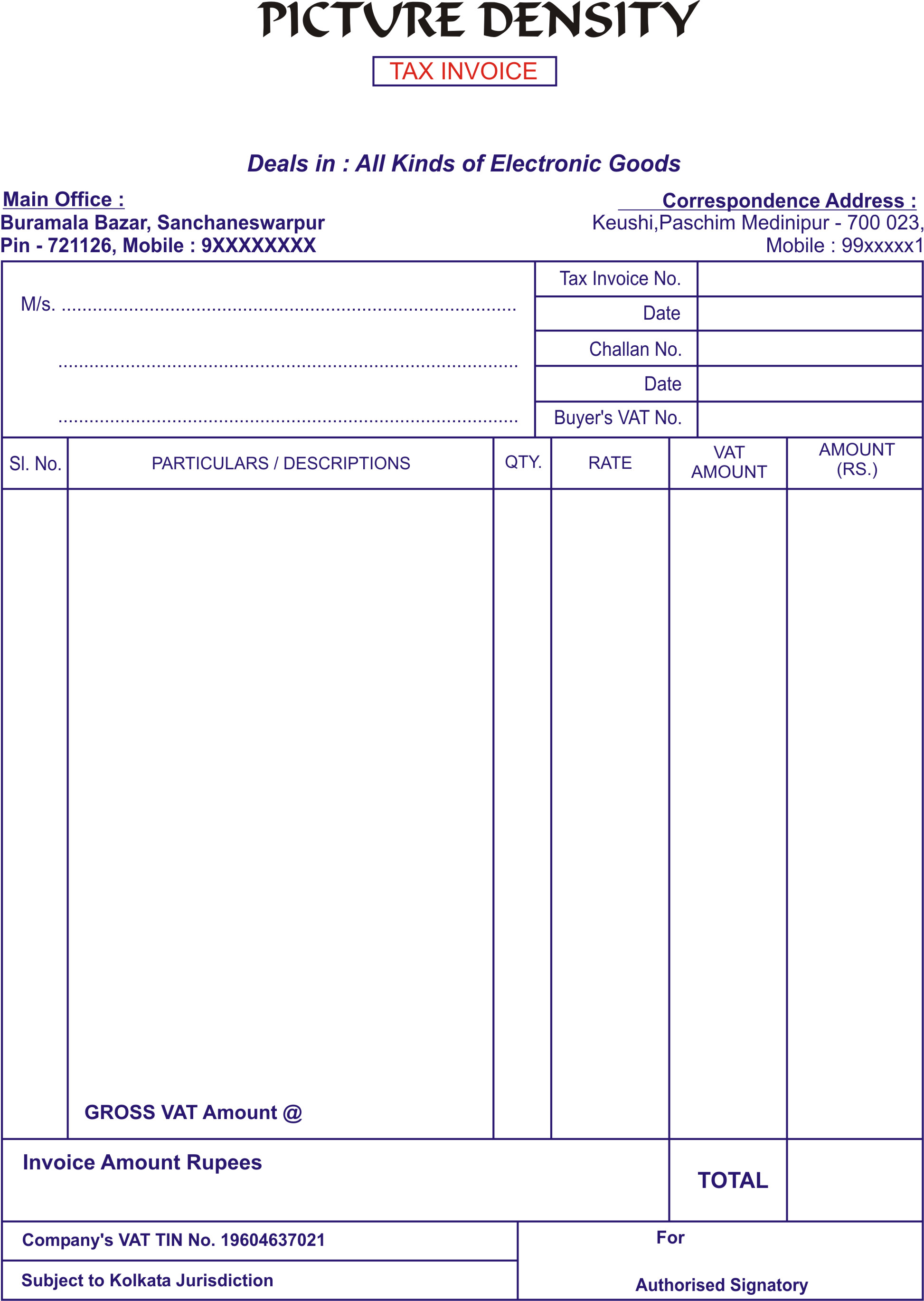

Tax Invoice English Matter Picture Density

44 Tax And Non Tax Invoice Templates Invoices Ready Made Office Templates

Tax Invoice Sign Or Stamp On White Background Vector Illustration Stock Vector Image Art Alamy

How To Prepare Tax Invoice Free Word Templates

Tally Format For Tax Invoice Print Formats Erpnext Forum

Business Invoice Forms Tax Invoices And Non Tax Invoice Samples

Tax Agency Dubai Economic Substance Report Template Spectrum

Tax Invoice Essentials

Invoice Payment Analysis Project Management

Illustration Of Unfill Paper Tax Invoice Form Royalty Free Cliparts Vectors And Stock Illustration Image

3

Getting Your Tax Invoice After Buying Toolset Toolset

50 Page Tax Invoice Statement Book Carbonless In Duplicate Buy Carbonless In Duplicate Invoice Statement Book Duplicate Book Invoice Product On Alibaba Com

What Are The Different Types Of Invoices For Small Business Tally Solutions

Bio Universal Multipurpose Tax Invoice Template In Word And Pdf Format Fully Editable

Tax Invoices Australian Taxation Office

How To Provide Eu Vat Tax Invoices In Easy Digital Downloads

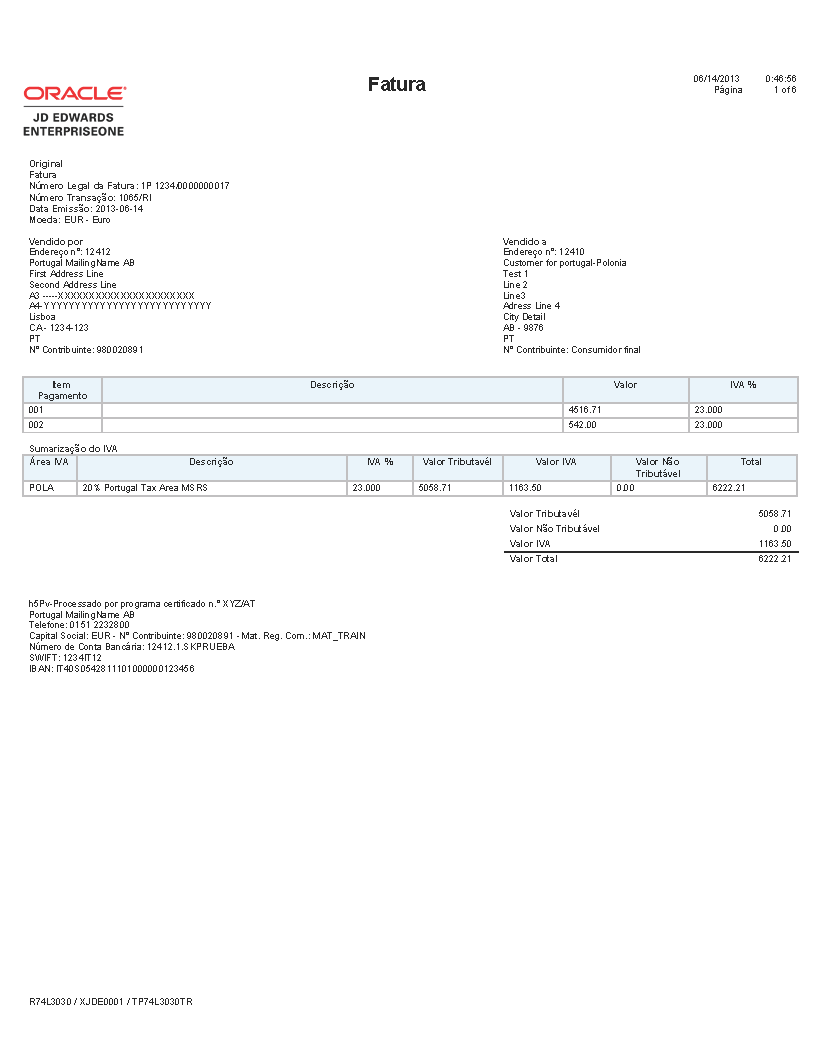

Invoice Samples For Portugal

Invoice With Tax Calculation

Tax Invoice At Rs 10 Unit Paper Stationery Id

Warehouse Supply Chains What Is Tax Invoice

Invoice Document

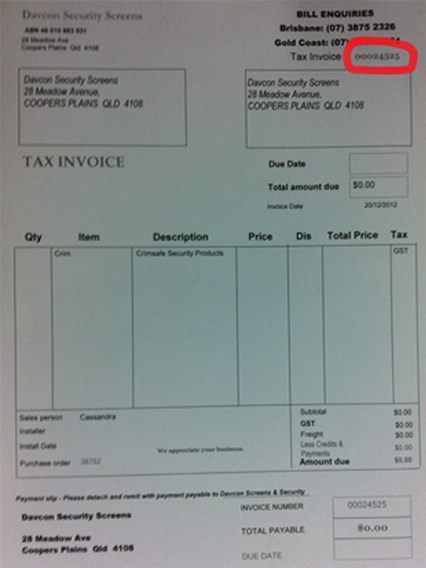

What Is A Tax Invoice Number Why Do I Need It Crimsafe Tweed

94 Standard Tax Invoice Template Pdf Now With Tax Invoice Template Pdf Cards Design Templates

Tax Invoice Requirements Blog

How To Read Your Tax Invoice Nextdc

Tax Invoice Under Vat In Uae Tax Invoice Requirements And Format

3

1

What Is A Tax Invoice What Does A Tax Invoice Mean Invoiceowl

Template Of Unfill Paper Tax Invoice Form Stockvectorkunst En Meer Beelden Van nvraagformulier Istock

Can I Get A Copy Of My Tax Invoice What Can We Help You With

Electric Shop Tax Invoice Cdr File Picture Density

Creating Correction Tax Invoices Price And Quantity Changes Sap Documentation

Business Invoice Forms Tax Invoices And Non Tax Invoice Samples

Gst I Gst Invoice Details I Essential Information

Saudi Vat Tax Invoices Issued Prior To 1 July Through Examples The Guide Also Clarifies That Contract Signed Before 11 5 Case Where A Tax Invoice Is Issued Before 11

Invoicing Under New Gst Regime

Pin On Debit

Draft Format Of Tax Invoice Under Gst

What Is Revised Invoice Format In Gst Gst Invoice Format

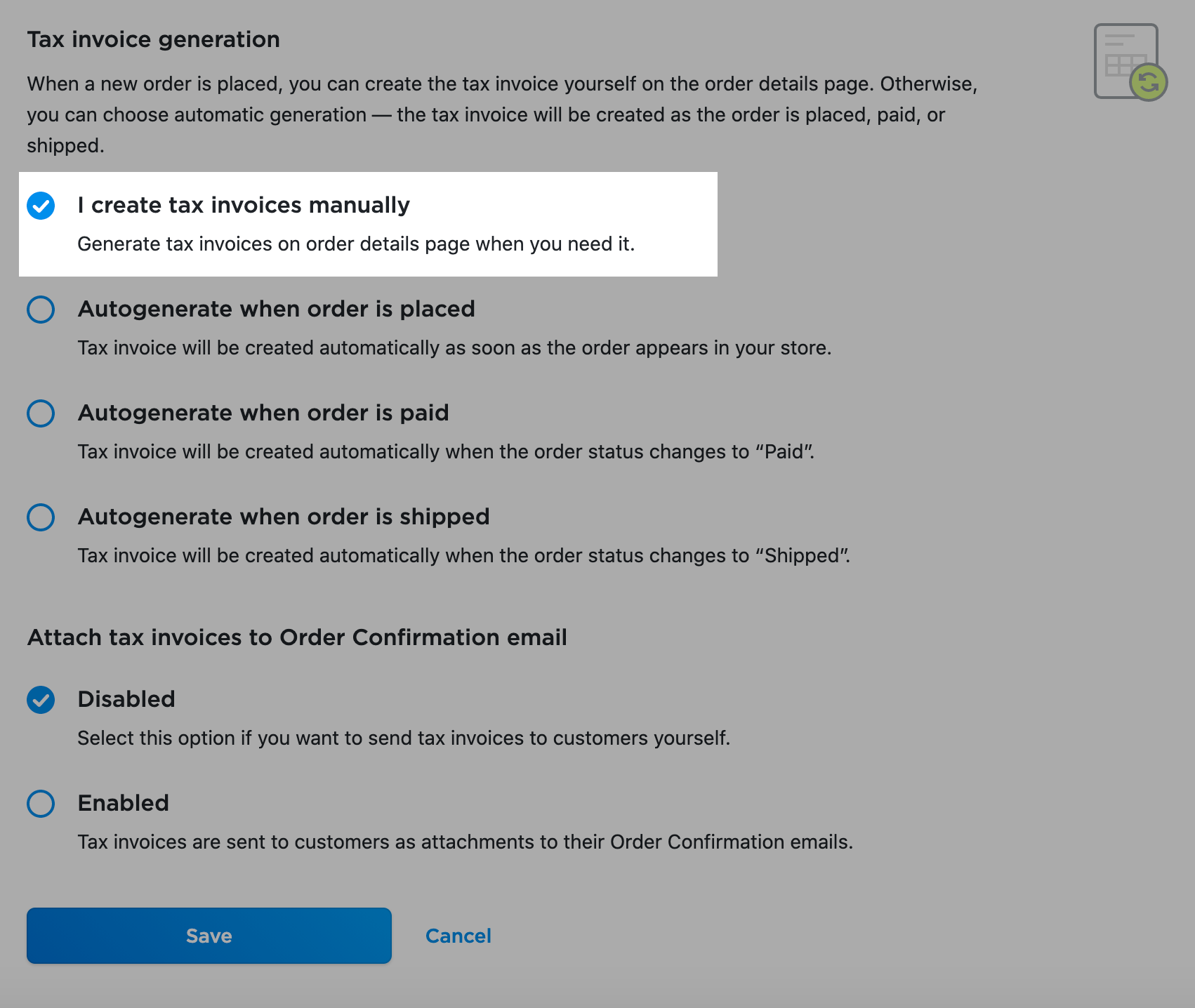

Creating Tax Invoices Ecwid Help Center

Tax Invoices Australian Taxation Office

Tax Invoice Debit And Credit Notes Ca Deepak

Tax Invoice To A Registered Customer Under Vat In Uae

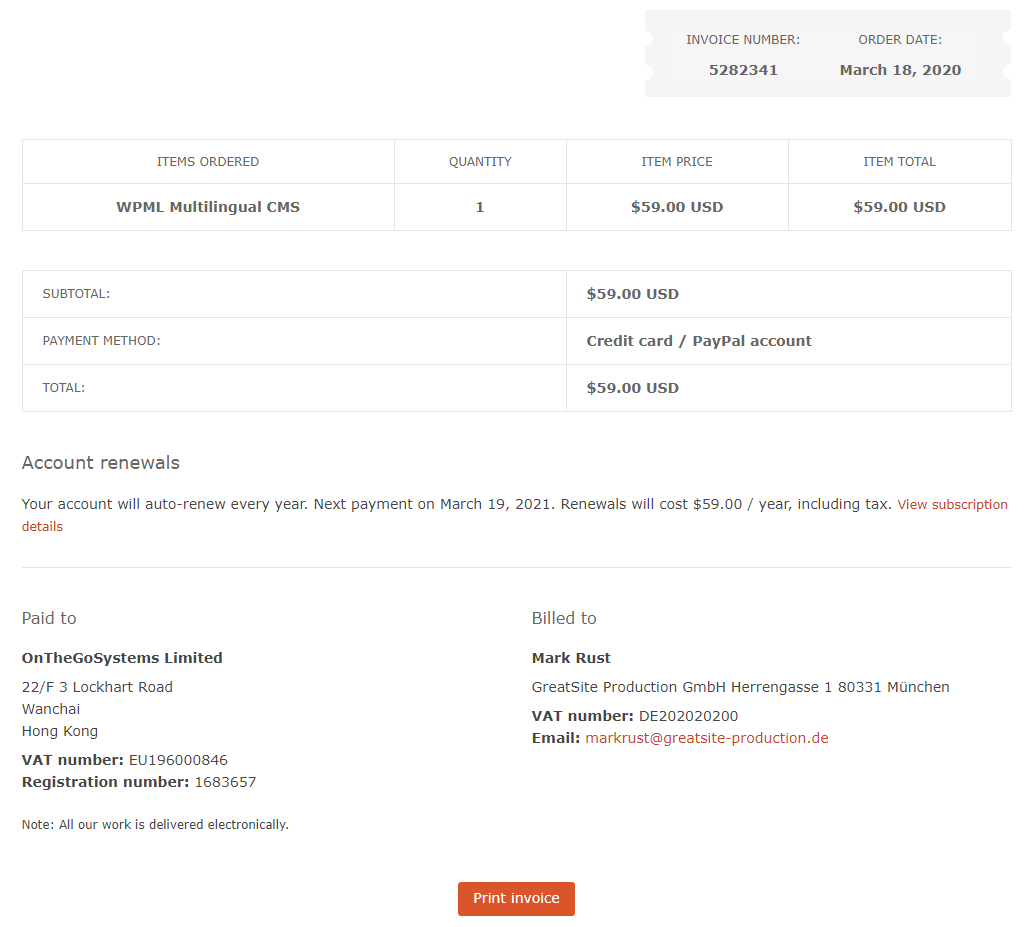

Frequently Asked Questions Archive Wpml

Hard Copy Tax Invoices For Crm Online On The Stand Alone Platform Microsoft Dynamics Crm Community

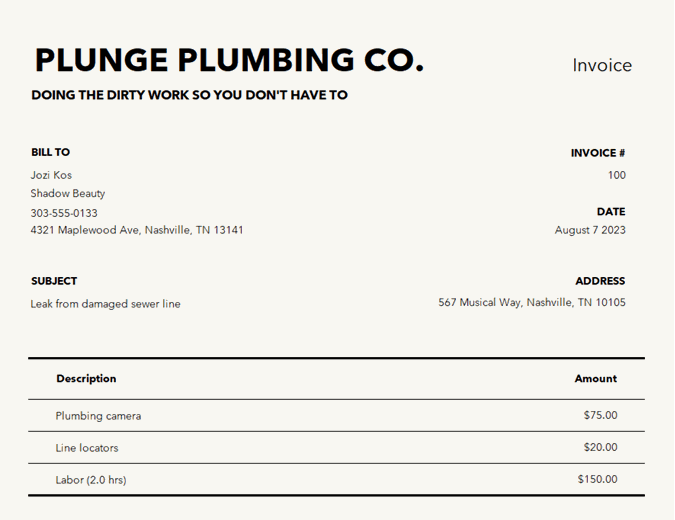

Invoice With Sales Tax

Tax Invoice Templates Quickly Create Free Tax Invoices

Warehouse Supply Chains What Is Tax Invoice

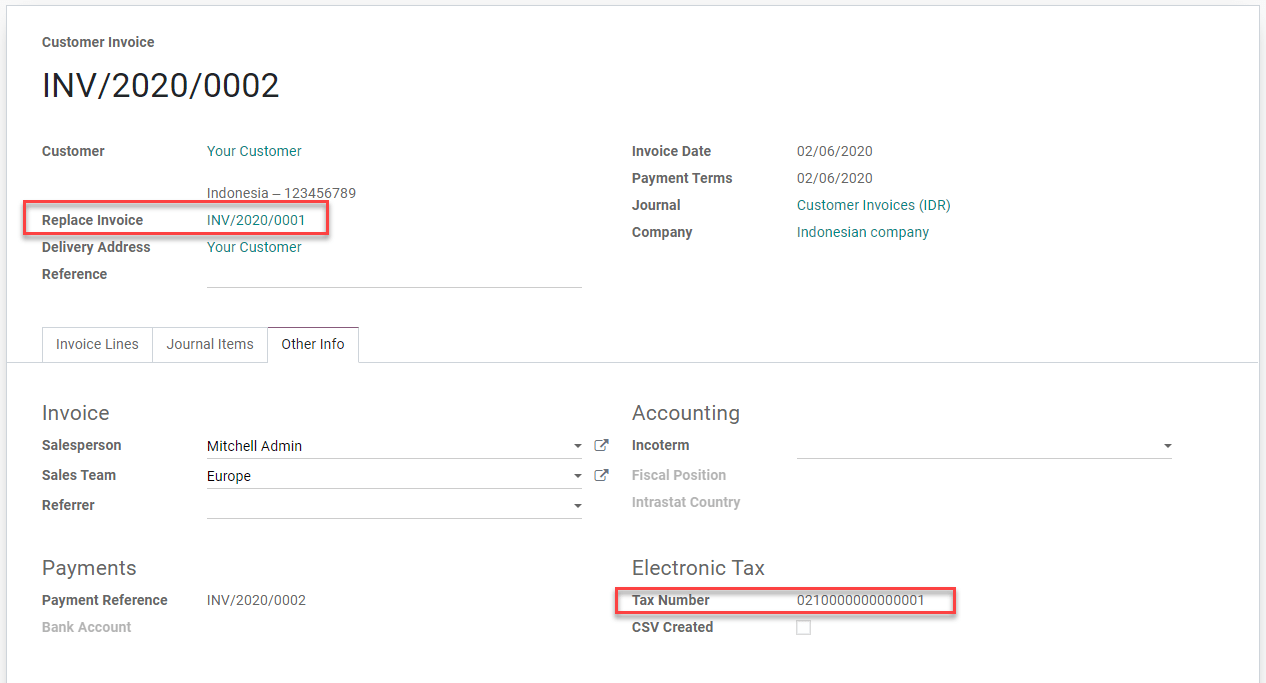

Indonesia Odoo 14 0 Documentation

Invoice Or Tax Invoice Your Questions Answered Debitoor Invoicing

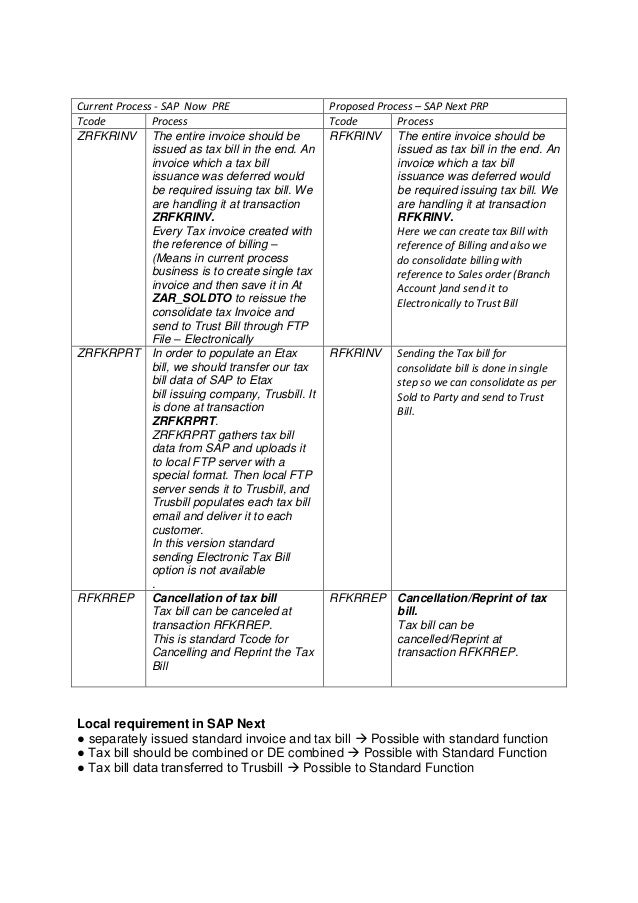

Korea Tax Bill Process Sap

What Is A Tax Invoice What Does A Tax Invoice Mean Invoiceowl

Frequently Asked Questions Archive Wpml

コメント

コメントを投稿